Skydiving Equipment Market Size

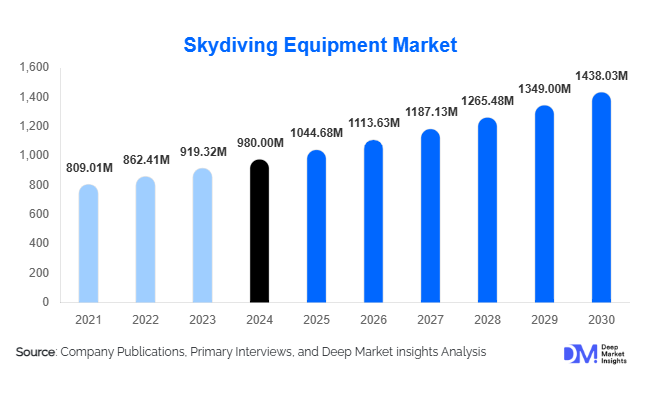

According to Deep Market Insights, the global skydiving equipment market size was valued at USD 980.00 million in 2024 and is projected to grow from USD 1,044.68 million in 2025 to reach USD 1,438.03 million by 2030, expanding at a CAGR of 6.6% during the forecast period (2025–2030). Market growth is primarily driven by the rising popularity of adventure sports, increasing disposable incomes, technological advancements in safety gear, and the expansion of indoor skydiving facilities across key regions.

Key Market Insights

- Increased consumer participation in adventure and extreme sports is driving demand for high-performance and safety-certified skydiving equipment.

- Technological innovations such as smart parachutes and AI-assisted safety systems are transforming equipment design and performance reliability.

- North America dominates the global market, accounting for the largest share due to mature adventure sports infrastructure and a strong base of professional skydivers.

- Europe is the fastest-growing regional market, driven by government initiatives to promote adventure tourism and the proliferation of skydiving schools.

- Asia-Pacific is emerging as a key growth hub, supported by the rising popularity of indoor skydiving facilities and expanding middle-class participation in premium adventure sports.

- Growing demand for eco-friendly and lightweight materials such as carbon-fiber composites is influencing product development trends.

Latest Market Trends

Integration of Smart Technology in Skydiving Gear

Manufacturers are incorporating digital technologies such as automatic activation devices (AADs), biometric monitoring sensors, and GPS trackers to improve safety and user experience. Smart helmets now include real-time altitude and wind speed tracking, while integrated cameras allow high-definition recording. These advancements not only enhance safety but also attract first-time jumpers seeking secure and interactive experiences.

Rise of Indoor Skydiving Facilities

Indoor skydiving centers are expanding globally, offering a controlled environment that appeals to beginners and urban populations. Facilities using vertical wind tunnels provide year-round training opportunities and promote wider access to the sport. The growth of indoor skydiving is also stimulating equipment sales, especially for helmets, suits, and training gear, while introducing more people to outdoor skydiving experiences.

Skydiving Equipment Market Drivers

Growing Popularity of Adventure Sports

Increasing global interest in adrenaline-driven outdoor activities is a major growth driver. Millennials and Gen Z consumers are fueling participation through social media-driven adventure culture. Rising tourism expenditure and the emergence of adventure tourism hubs in destinations like Dubai, New Zealand, and the U.S. are further supporting market growth. Competitive skydiving events and record-attempt shows broadcast globally also contribute to the sport’s rising appeal.

Advancements in Safety and Performance Materials

Continuous improvements in materials such as ripstop nylon, Kevlar, and high-tensile composites are enhancing equipment reliability and reducing weight. Safety features like advanced automatic activation devices, reinforced harnesses, and multi-canopy systems are increasing confidence among participants and attracting new entrants. These developments are also encouraging repeat participation and professional training programs worldwide.

Market Restraints

High Equipment and Maintenance Costs

Skydiving equipment requires regular inspection, maintenance, and replacement of components to ensure safety compliance, leading to high operational costs. Parachutes and AAD systems are expensive, limiting adoption among casual users. These costs can restrict market access for budget-conscious consumers and smaller skydiving centers.

Regulatory and Safety Compliance Challenges

Stringent safety regulations across different countries require manufacturers to meet certification standards such as FAA, ISO, and USPA approvals. Delays in certification and regional variations in safety norms increase production complexity and costs. Liability concerns and accident risks also act as deterrents to market growth, particularly in emerging markets with less developed regulatory infrastructure.

Skydiving Equipment Market Opportunities

Emergence of Eco-Friendly and Lightweight Gear

With growing environmental awareness, manufacturers are developing biodegradable and recyclable materials for parachutes and accessories. Lightweight composites and modular gear are gaining popularity among professional skydivers and eco-conscious consumers, offering opportunities for product differentiation.

Expansion of Training and Recreational Centers

Rapid growth in skydiving schools and simulation facilities presents a key opportunity for equipment manufacturers. Collaboration between equipment suppliers and indoor centers is helping to introduce first-time users to the sport safely, driving equipment sales. Franchising opportunities and tourism partnerships are further enhancing market penetration in emerging economies.

Product Type Insights

Canopies represent the largest and most critical product segment, driven by performance upgrades in glide ratio, steering precision, and reliability. The rise of new disciplines such as canopy piloting and wingsuit BASE integration is accelerating replacement cycles as users seek higher-performance fabrics and aerodynamic profiles. Harness & container systems are witnessing robust growth, supported by increasing demand for comfort, modularity, and customizable mounts for AAD integration across tandem and sport configurations. AADs & electronics are rapidly gaining adoption due to regulatory enforcement, falling component costs, and feature expansion, including telemetry, Bluetooth connectivity, and real-time data logging. Protective gear and apparel are benefiting from rising safety standards, discipline-specific apparel innovation, and consumer fashion trends that emphasize personalization and branding. Finally, accessories, such as goggles, gloves, altimeter mounts, and camera housings, are propelled by aftermarket sales, frequent replacements, and impulse purchases at drop zones and online platforms.

Application Insights

Recreational and sport skydiving lead overall demand, fueled by a surge in first-time jumpers, competitive events, and the influence of social media platforms showcasing skydiving experiences. Commercial and adventure tourism applications are expanding as operators invest in tandem rigs, student kits, and training capacity to meet growing tourist participation. Military and defense applications remain a stable and high-value segment, driven by modernization programs, procurement cycles, and performance demands for tactical and high-altitude operations. Training and indoor facilities are witnessing steady growth as urbanization and the proliferation of wind tunnels fuel demand for practice and simulation gear that bridges indoor and outdoor training environments.

End-User Insights

Individual consumers primarily drive demand through brand trust, safety certifications, and social validation from peer groups. Skydiving centers and schools focus on total cost of ownership, durability, and liability compliance as primary purchasing factors. Military and government buyers emphasize mission-specific performance, certification standards, and long-term procurement cycles. Specialized commercial operators, including photography and stunt teams, prioritize reliability, custom-engineered systems, and service support for high-frequency use cases.

Distribution Channel Insights

Direct/OEM contracts dominate institutional and defense supply chains, where long-term servicing agreements and equipment customization are key differentiators. Specialist retailers and drop-zone shops thrive on impulse and immediate replacement sales, offering localized service and repair capabilities. Online sales channels continue to gain traction due to convenience, broader product selection, customization options, and competitive pricing, especially in accessories and apparel segments.

Pricing Tier Insights

Premium/professional equipment leads revenue generation, targeting competitive athletes, experienced skydivers, and professional centers that prioritize top-tier safety and performance. Mid-range products attract the largest consumer base, balancing affordability with certified safety features. Entry-level/student/tandem gear is driven by schools and tourism operators prioritizing cost-efficiency and robust safety for first-time users.

| By Product Type | By Application | By End User | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest and most mature market, supported by a vast network of drop zones, professional training schools, and a well-established community of private skydivers. High participation rates and strong competitive circuits create consistent equipment replacement cycles and demand for premium-grade products. The U.S., as the single largest national market, leads regional growth, driven by a dense network of certified operators, widespread recreational participation, and continued investments in safety innovations.

Europe

Europe represents the fastest-growing regional market, underpinned by stringent safety regulations and an organized competitive skydiving scene. Countries such as the U.K., France, and Germany are expanding both outdoor and indoor facilities. Regulatory requirements for certified AADs, canopies, and inspection services have elevated consumer preference for high-spec, premium-grade products. Additionally, government programs promoting adventure tourism and sporting events continue to stimulate market development.

Asia-Pacific

Asia-Pacific is emerging as a high-potential region due to rapid economic growth, expanding adventure tourism, and rising disposable incomes in countries like India, China, and Australia. New drop zones, government-supported tourism campaigns, and indoor wind tunnel installations are accelerating awareness and participation. Increasing social media engagement and the aspirational appeal of adventure sports are fueling adoption across mid-range and entry-level equipment segments, with the region showing the highest CAGR globally.

Latin America

Latin America’s skydiving equipment market is expanding gradually, supported by new operators and tourism package integrations in countries such as Brazil, Mexico, and Argentina. Growth is primarily driven by the rising number of training schools and the inclusion of tandem skydiving in travel itineraries. However, demand remains price-sensitive, with strong uptake of cost-efficient tandem rigs and student equipment favored by local operators.

Middle East & Africa

The Middle East and Africa present niche but fast-evolving opportunities, driven by dual demand streams: military procurement and adventure tourism. The UAE leads the regional market, with high-profile facilities like Skydive Dubai promoting premium consumer demand. Meanwhile, selected African markets, such as South Africa and Namibia, are witnessing expansion in adventure tourism circuits. Defense-grade parachute acquisitions and adventure-oriented experience packages together underpin regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Skydiving Equipment Market

- United Parachute Technologies (UPT)

- Sun Path Products, Inc.

- LB Altimeters

- Velocity Sports Equipment

- Mirage Systems

- Airtec GmbH

- NZ Aerosports

- Intrudair

- Cookie Composites

Recent Developments

- In August 2025, UPT introduced a new AI-assisted automatic activation device (AAD) designed to enhance canopy deployment accuracy and safety response.

- In May 2025, Sun Path Products launched its “EcoFly” series harness system featuring lightweight, recyclable composite materials to reduce carbon footprint.

- In February 2025, Airtec GmbH partnered with major European training centers to integrate real-time telemetry systems for student safety monitoring during freefall.