Portable Heaters Market Size

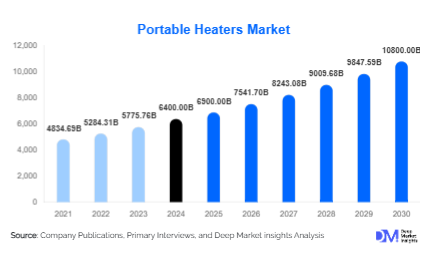

According to Deep Market Insights, the global portable heaters market size was valued at USD 6,400 million in 2024 and is projected to grow from USD 6,900 million in 2025 to reach USD 10,800 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025-2030). The portable heaters market growth is primarily driven by rising demand for energy-efficient heating appliances, the surge in home and office remodeling projects, and expanding adoption of compact heating solutions in emerging economies.

Key Market Insights

- Energy-efficient and eco-friendly heaters are gaining traction, supported by regulatory pressure for low-emission and safe heating appliances.

- Residential use dominates global demand, with consumers increasingly investing in compact, affordable heaters for supplemental heating.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and colder-than-average winters in parts of China, Japan, and India.

- North America and Europe collectively account for over 55% of the 2024 market share, supported by mature home appliance industries and strong seasonal demand cycles.

- E-commerce platforms are reshaping sales channels, offering greater access to a wide product range, consumer reviews, and competitive pricing.

- Technological innovations, such as IoT-enabled smart heaters with app-based controls, are transforming consumer expectations for convenience and safety.

What are the latest trends in the portable heaters market?

Smart and Connected Heaters

Portable heaters are increasingly being integrated with smart home ecosystems. IoT-enabled devices can be remotely controlled via smartphones, allow programmable heating schedules, and provide real-time energy consumption data. Consumers in developed markets are adopting these heaters as part of larger smart home investments, which enhances convenience while reducing energy bills. The trend is expected to accelerate as more manufacturers embed Wi-Fi connectivity, voice assistant compatibility, and AI-based climate adjustment in their product lines.

Eco-Friendly Heating Solutions

Environmental regulations and consumer awareness are pushing demand for energy-efficient heaters. Ceramic heaters and infrared heaters, known for their lower energy consumption, are increasingly replacing traditional resistance heaters. Manufacturers are focusing on compliance with energy labeling standards, while innovations in low-wattage, high-efficiency heating elements are becoming mainstream. This trend is particularly strong in Europe, where stringent environmental regulations favor eco-certified appliances.

What are the key drivers in the portable heaters market?

Growing Residential Heating Demand

The rise in single-person households, apartments, and small office spaces is driving demand for portable heaters that provide localized heating without high installation costs. Supplemental heating in winter months, especially in regions with fluctuating weather, further accelerates adoption.

Shift Toward Energy Efficiency

Global governments are introducing stricter efficiency standards, incentivizing consumers to adopt low-energy heating appliances. Advances in ceramic and infrared heating technologies align with this trend, reducing both operating costs and carbon emissions.

Expansion of Online Retail Channels

E-commerce has become a critical sales driver. Consumers prefer online channels due to a wider variety, transparent reviews, and promotional discounts. In 2024, online distribution accounted for nearly 35% of global sales, and this share is expected to grow as digital platforms strengthen penetration in APAC and LATAM markets.

What are the restraints for the global market?

Safety Concerns

Portable heaters, particularly low-cost variants, pose risks such as overheating, fire hazards, and accidental burns. These safety concerns often lead to product recalls and stricter compliance requirements, which can slow adoption.

Seasonal Dependence

The demand for portable heaters is heavily seasonal, peaking during winter and dropping sharply in warmer months. This cyclical nature of sales leads to fluctuating revenues, inventory challenges, and dependency on climatic variations.

What are the key opportunities in the portable heaters industry?

Integration with Smart Homes

As smart home adoption rises globally, portable heater manufacturers have an opportunity to expand market share by embedding AI-based climate control, app-based operation, and energy analytics. Partnerships with smart home ecosystem providers like Amazon Alexa, Google Home, and Apple HomeKit are expected to create significant new revenue streams.

Rising Demand in Developing Economies

Urbanization and improved electrification in developing economies, particularly in the Asia-Pacific and parts of Africa, present untapped growth opportunities. Growing middle-class affordability and exposure to online retail channels are encouraging consumers to adopt affordable heating solutions.

Eco-Certified and Green Products

Government-backed programs promoting energy-efficient appliances create opportunities for eco-certified portable heaters. Companies investing in R&D for low-emission technologies and recyclable components can capture environmentally conscious consumers, particularly in Europe and North America.

Product Type Insights

Fan heaters lead the market with a 32% share of the 2024 global revenues, owing to their affordability, rapid heating capability, and widespread availability. Ceramic heaters are the fastest-growing sub-segment due to their energy efficiency and compact design, especially in urban households where space optimization is critical.

End-Use Insights

Residential end-use dominates with 58% of the global market in 2024, reflecting strong household adoption as supplemental heating. The commercial segment is expanding steadily, with offices, retail outlets, and hospitality chains adopting portable heaters for flexible heating solutions. Industrial adoption remains niche but growing, particularly in construction and temporary worksites.

Distribution Channel Insights

Offline retail remains the leading channel with a 65% share in 2024, supported by consumer preference for physical product trials. However, online channels are growing at a CAGR of 12% during 2025-2030, driven by digital promotions, easy price comparisons, and greater penetration in emerging economies.

| By Product Type | By Power Rating | By Portability Type | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market share in 2024, with the U.S. leading due to colder winters and high adoption of energy-efficient appliances. Canada is also a major contributor, while Mexico shows moderate growth tied to urban housing developments.

Europe

Europe held 27% of global revenues in 2024, led by Germany, the U.K., and France. Strict energy regulations, combined with consumer preference for eco-friendly appliances, are shaping product demand. Eastern Europe is emerging as a high-growth area due to colder climates and increasing disposable income.

Asia-Pacific

APAC is the fastest-growing region, forecast to expand at a CAGR of 12.1% through 2030. China leads in both manufacturing and consumption, while Japan and South Korea adopt advanced heater technologies. India is witnessing rising demand due to growing urban middle-class households and online retail expansion.

Latin America

Latin America shows steady growth, with Brazil and Argentina driving demand for affordable heaters in urban households. Seasonal variations are less extreme than in North America and Europe, which moderates growth but creates opportunities for hybrid and energy-efficient solutions.

Middle East & Africa

MEA remains a smaller market but is growing steadily. South Africa is the key demand center, while GCC countries adopt heaters for office and hospitality applications during cooler months. Electrification improvements across African nations will unlock future potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Heaters Market

- Dyson Ltd.

- De’Longhi S.p.A.

- Honeywell International Inc.

- Vornado Air LLC

- Jarden Consumer Solutions (Holmes Products)

- Lasko Products

- Midea Group

- Panasonic Corporation

- Stadler Form

- Gree Electric Appliances

- Electrolux AB

- Havells India Ltd.

- Rowenta (part of Groupe SEB)

- Bajaj Electricals Ltd.

- Crane USA

Recent Developments

- In May 2025, Dyson introduced a new line of bladeless portable heaters with AI-based temperature regulation and air purification features.

- In April 2025, De’Longhi announced a strategic partnership with Amazon to integrate Alexa voice control into its smart portable heaters.

- In February 2025, Midea Group expanded its production capacity in India to meet rising APAC demand for low-cost portable heaters.