Plastic Bottle Recycling Market Size

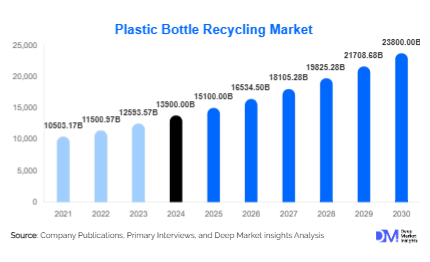

According to Deep Market Insights, the global plastic bottle recycling market size was valued at USD 13,900 million in 2024 and is projected to grow from USD 15,100 million in 2025 to reach USD 23,800 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025-2030). The market growth is primarily driven by increasing government regulations on single-use plastics, rising consumer awareness about sustainability, and strong demand for recycled plastics in packaging, textiles, and construction industries.

Key Market Insights

- PET bottles dominate the recycling industry, accounting for nearly 65% of recycled plastic bottles in 2024, owing to their wide use in beverage packaging and high recyclability rate.

- Mechanical recycling continues to hold the largest market share, but chemical recycling technologies are gaining momentum due to their ability to process contaminated or multi-layered bottles.

- Asia-Pacific leads the global market, with China and India driving collection and processing capacity expansion.

- Europe is the fastest-growing region, backed by strict EU circular economy policies and bottle deposit-return schemes.

- Food & beverage packaging remains the largest application, representing over 40% of end-use demand in 2024.

- Technological innovation, such as AI-driven sorting and advanced depolymerization, is improving the efficiency and economic viability of recycling plants.

What are the latest trends in the plastic bottle recycling market?

Deposit-Return Schemes (DRS) Driving Collection Efficiency

Governments worldwide are implementing deposit-return schemes to improve bottle collection rates. For example, Germany and the Nordic countries have achieved over 90% collection rates through DRS. This trend is now expanding to North America and parts of Asia. By offering monetary incentives to consumers for returning bottles, these programs are significantly boosting supply for recyclers and ensuring higher-quality input streams for recycling facilities.

Advances in Chemical Recycling Technologies

Chemical recycling methods, including pyrolysis and depolymerization, are gaining traction as they can convert complex or contaminated plastic bottles into high-quality monomers. This enables the production of virgin-grade recycled plastics suitable for food-contact applications. While still capital-intensive, chemical recycling has attracted significant investments from major players in Europe and Asia, signaling a shift toward scalability and integration into circular supply chains.

What are the key drivers in the plastic bottle recycling market?

Stringent Regulations on Single-Use Plastics

Global bans and restrictions on single-use plastics are forcing companies to adopt recycled content in packaging. The European Union’s directive mandating at least 25% recycled content in PET bottles by 2025 is a prime example. Such regulations are pushing beverage producers and FMCG companies to secure reliable supplies of recycled resins, driving overall market demand.

Growing Consumer Preference for Sustainable Packaging

Consumers are increasingly demanding eco-friendly products. Brands are responding by using recycled PET (rPET) in bottles and packaging. Leading beverage companies such as Coca-Cola and PepsiCo have committed to 50% rPET usage by 2030, creating large-scale demand for recycled plastic bottle feedstock. This shift in consumer behavior is reshaping corporate supply chains and accelerating recycling infrastructure investments.

Expansion of Textile and Fiber Applications

Recycled PET is increasingly used to manufacture textiles, carpets, and industrial fibers. The fashion industry, in particular, is adopting recycled polyester (rPET) to reduce its carbon footprint. Global sportswear brands such as Adidas and Nike have incorporated rPET into apparel and footwear, creating a rapidly growing demand stream beyond packaging.

What are the restraints for the global market?

High Processing and Collection Costs

The recycling process remains cost-intensive due to collection inefficiencies, contamination of plastic waste, and the need for advanced sorting technology. In many regions, the cost of producing recycled resin exceeds that of virgin resin, making profitability a challenge unless subsidized by government incentives.

Quality and Safety Concerns in Food-Grade Applications

Recycled plastics often face challenges in meeting strict safety and quality standards for food and beverage packaging. Contamination risks and degradation of plastic properties during recycling can limit their applicability in sensitive industries. Ensuring traceability and compliance adds complexity and cost for recyclers.

What are the key opportunities in the plastic bottle recycling industry?

Adoption of Advanced AI and Robotics in Sorting

Investment in AI-driven sorting systems and robotics can drastically improve material recovery efficiency and reduce contamination rates. This opportunity allows recyclers to scale operations, lower costs, and provide consistent feedstock quality, addressing one of the key challenges in recycling economics.

Integration of Recycling with Brand Sustainability Goals

Global brands are under increasing pressure to achieve net-zero and circular economy commitments. Partnering with recyclers or investing directly in recycling facilities presents opportunities for both players. Co-branded recycling initiatives and vertically integrated supply chains are emerging as strategic moves to secure recycled material availability.

Expansion in Emerging Markets

Countries in Asia, Africa, and Latin America are experiencing rapid growth in plastic consumption, but have underdeveloped recycling infrastructure. Establishing collection and recycling facilities in these regions offers a dual opportunity: addressing environmental concerns and tapping into high-growth consumer markets for recycled packaging materials.

Product Type Insights

PET bottles dominate the market with over 65% share in 2024 due to high demand from the beverage industry and established collection channels. HDPE bottles account for around 20%, driven by usage in household and personal care products. Other resins, such as PP and LDPE, make up the remaining share but are growing slowly due to recycling complexities and limited processing capacity.

Application Insights

Food & beverage packaging leads the application segment, accounting for nearly 42% of total demand in 2024. Non-food packaging, such as detergent and cosmetic bottles, represents another 25%. Textiles and fibers are emerging as the fastest-growing application, forecasted to grow at over 11% CAGR due to the fashion industry’s shift toward sustainable materials.

| By Resin Type | By the Recycling Process | By Technology | By Application | By End-Use Industry | By Geography |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market share in 2024. The U.S. leads the region, with strong state-level recycling mandates and corporate sustainability programs driving demand. Canada is expanding deposit-return systems, while Mexico is witnessing growth through increased export of rPET to the U.S.

Europe

Europe represents 31% of the global market in 2024, making it the largest region. Countries like Germany, France, and the U.K. are front-runners in recycling innovation due to strict EU directives and advanced infrastructure. Europe is also the fastest-growing region, expanding at a CAGR of 10.5% through 2030.

Asia-Pacific

APAC holds a 29% share, with China, India, and Japan as major contributors. China has invested heavily in chemical recycling, while India’s growing middle-class demand is creating new opportunities for recycled packaging. Japan is a leader in recycling rates but has limited domestic demand, relying on exports of recycled pellets.

Latin America

Latin America accounts for around 7% of the market, led by Brazil and Argentina. Brazil has an active informal recycling sector, but infrastructure development remains uneven. Growing corporate demand for recycled packaging is expected to boost investments in the region.

Middle East & Africa

MEA represents about 5% of the global market. South Africa has well-established collection networks, while the Gulf states are investing in large-scale recycling facilities as part of their circular economy strategies. The region’s growth potential is high but still nascent compared to APAC and Europe.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plastic Bottle Recycling Market

- Veolia Environnement S.A.

- SUEZ Group

- Indorama Ventures

- Plastipak Holdings

- Biffa Plc

- Alpek S.A.B. de C.V.

- Evergreen Recycling

- CarbonLite Industries

- Far Eastern New Century Corporation

- Loop Industries

- KW Plastics

- Envision Plastics

- Clear Path Recycling

- PolyQuest, Inc.

- PetStar

Recent Developments

- In June 2025, Indorama Ventures announced the expansion of its PET bottle recycling capacity in India, adding over 50,000 tons annually to meet regional demand.

- In May 2025, Veolia launched a new AI-driven sorting plant in France, aimed at improving the recovery rates of PET and HDPE bottles.

- In March 2025, SUEZ partnered with a major FMCG brand to establish a closed-loop rPET supply chain in Europe.