Optical Films Market Size

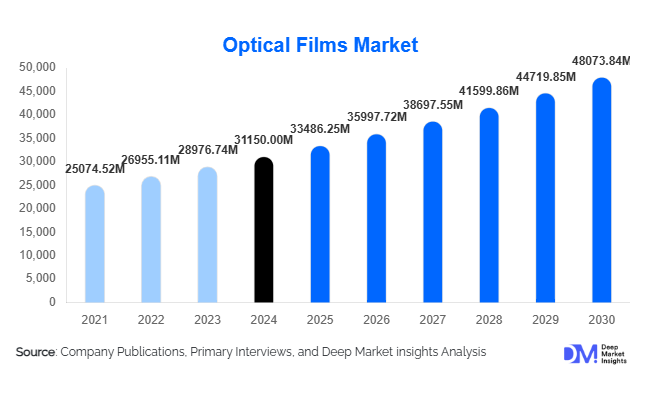

According to Deep Market Insights, the global optical films market size was valued at USD 31,150.00 million in 2024 and is projected to grow from USD 33,486.25 million in 2025 to reach USD 48,073.84 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The growth of the optical films market is primarily driven by rising adoption of advanced display technologies, growing demand for high-resolution and energy-efficient screens, and increasing penetration of flexible and automotive displays worldwide.

Key Market Insights

- Polarizing films remain the largest product category, accounting for nearly half of total optical film demand in 2024, owing to their critical role in LCD and OLED displays.

- Asia-Pacific dominates global production, contributing over 54% of market revenue in 2024, supported by strong manufacturing ecosystems in China, Japan, and South Korea.

- Rising demand for automotive displays and smart glass applications is creating new revenue streams for film manufacturers and coating specialists.

- Technological innovation in flexible, anti-reflective, and privacy films is reshaping the competitive landscape and driving premium product growth.

- Supply-chain localization initiatives such as “Make in India” and “Made in China 2025” are accelerating regional production and reducing import dependency.

- Increasing sustainability focus is prompting R&D investment in recyclable, bio-based, and low-carbon optical film materials.

Latest Market Trends

Adoption of Flexible and Foldable Display Films

The rapid evolution of foldable smartphones, rollable TVs, and curved monitors has intensified demand for ultra-thin, flexible optical films. Manufacturers are developing films with improved elasticity, scratch resistance, and optical uniformity suitable for dynamic bending. This trend is led by Asian electronics giants investing in advanced polymer substrates such as high-durability PET and polyimide films. Flexible display adoption in consumer electronics, automotive interiors, and AR/VR headsets continues to expand the addressable market.

Growing Penetration of Automotive and Smart Glass Applications

Automotive OEMs are integrating more in-vehicle displays – instrument clusters, infotainment screens, and heads-up displays (HUDs). These require optical films offering anti-glare, heat-resistant, and high-contrast properties. Parallelly, smart glass in buildings and renewable-energy glazing solutions are incorporating optical coatings for improved light management. This crossover into automotive and architectural sectors is broadening end-use diversity, encouraging suppliers to design multi-functional, durable film systems.

Optical Films Market Drivers

Surging Demand for High-Definition and Energy-Efficient Displays

The ongoing migration to 4K and 8K resolutions, alongside thinner and more energy-efficient screens, boosts demand for brightness-enhancement and polarizing films. These films enhance contrast, viewing angles, and optical clarity, directly influencing device performance. The consumer electronics sector—particularly smartphones, tablets, and televisions—remains the single largest demand generator.

Expansion of New End-Use Sectors

Beyond electronics, optical films are gaining traction in automotive, AR/VR, and smart-glass applications. The automotive industry’s shift toward digital cockpits and HUDs is especially significant, as these displays require optical coatings to maintain clarity under variable lighting and temperature conditions. In parallel, AR/VR devices and wearable displays require lightweight films with precision light control, fostering a high-value growth segment for manufacturers.

Regional Manufacturing and Policy Support

Asia-Pacific governments continue to support display and electronics manufacturing through targeted incentives and public–private partnerships. Initiatives such as “Made in China 2025” and “Make in India” are encouraging local production of optical films, coatings, and backlight components. This policy support, coupled with technological collaborations and reduced logistics costs, reinforces the region’s dominance and attracts CapEx inflows from global OEMs and materials suppliers.

Market Restraints

Volatility in Raw-Material Prices

Optical film production depends on specialty resins, coatings, and polymer substrates such as PET and polycarbonate. Price fluctuations in these inputs can significantly affect profit margins and end-product pricing. Geopolitical tensions, supply-chain disruptions, and fluctuating energy costs exacerbate cost volatility, posing a major challenge to consistent profitability.

Commoditization and Price Competition

As more regional manufacturers enter the industry, particularly in Asia, basic film types face commoditization. Aggressive price competition erodes margins and discourages smaller players from investing in R&D. Manufacturers are therefore compelled to differentiate through technological performance – for example, via anti-reflective, privacy, or conductive functionalities – to maintain profitability in an increasingly saturated market.

Optical Films Market Opportunities

Automotive Display Integration

The accelerating adoption of connected and autonomous vehicles presents a significant opportunity for optical film suppliers. Demand for anti-glare, anti-fingerprint, and temperature-resistant films is expected to rise sharply. Automotive OEMs are exploring curved and transparent HUD surfaces, creating new niches for advanced optical materials. Tier-1 suppliers are partnering with film manufacturers to co-develop automotive-grade optical coatings that meet regulatory standards for luminance and visibility.

AR/VR and Smart-Glass Expansion

The growth of augmented and virtual reality devices is stimulating demand for optical films with enhanced transparency, polarization control, and color accuracy. Likewise, smart windows and solar-adaptive glazing in buildings integrate optical films to modulate light and heat. These emerging use cases diversify end-market exposure and promise high margins for companies that invest in specialized coating and lamination technologies.

Regional Localization and Supply-Chain Diversification

Global supply-chain restructuring is encouraging manufacturers to establish local production hubs. By expanding facilities in India, Vietnam, and Eastern Europe, companies can reduce dependence on East Asian supply routes, mitigate tariff exposure, and serve regional display assemblers faster. Governments offering tax incentives and low-interest loans further enhance investment attractiveness, creating a clear pathway for new entrants and joint ventures.

Product Type Insights

Polarizing films lead the market, representing about 48% of global revenue in 2024. Their indispensable role in controlling light transmission and contrast in LCD and OLED panels secures this dominance. Brightness-enhancement films and anti-reflective coatings follow, catering to high-resolution screens requiring optimal luminance efficiency. The growing use of ITO transparent conductive films in touch displays and solar applications adds incremental demand from both electronics and renewable-energy sectors.

Material Insights

Polyester (PET) films remain the primary substrate due to their cost efficiency, optical clarity, and adaptability to thin-film processing. PET accounted for the majority of substrate usage in 2024. Specialty polymers such as polycarbonate and acrylic films are gaining traction in applications requiring higher impact resistance or flexibility, particularly in foldable and automotive displays.

Application Insights

Smartphones and tablets constitute the leading application segment, capturing roughly 36% of global demand in 2024. Continuous smartphone innovation and screen upgrades sustain high consumption of polarizing and brightness-enhancement films. Televisions and large-format displays also remain major contributors, while automotive and AR/VR segments are projected to record the fastest growth rates through 2030 due to increasing digitalization and immersive content experiences.

End-Use Industry Insights

Consumer electronics dominate, accounting for the largest end-use share and acting as the primary demand driver. The automotive sector is the fastest-growing end-use, expanding optical film adoption for dashboards, HUDs, and infotainment systems. The renewable-energy and smart-building industries are emerging consumers, integrating optical coatings for solar panels and adaptive glazing. Export-driven manufacturing in Asia-Pacific – notably from China, Japan, and South Korea – supplies a major portion of global display film requirements.

| By Film Type | By Material Type | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounted for approximately 54% of global optical film revenue in 2024. China remains the largest country-level market (24% share), followed by South Korea and Japan. Government incentives, strong semiconductor and display ecosystems, and regional localization policies underpin dominance. India represents the fastest-growing market in Asia due to expanding consumer-electronics manufacturing and supportive government initiatives.

North America

North America held about a 28–30% share in 2024, led by the U.S. Demand arises from premium consumer electronics, AR/VR devices, and advanced automotive displays. Rising investment in sustainable materials and local semiconductor fabs supports future growth potential.

Europe

Europe contributed roughly 20% of global revenue in 2024. The region’s emphasis on eco-friendly materials, stringent recycling directives, and strong automotive R&D fosters optical-film innovation. Germany, France, and the U.K. lead adoption, particularly in automotive and smart-glass applications.

Latin America

Latin America accounts for about 7% of market value, with Brazil and Mexico as key demand centers. Rising penetration of televisions and smartphones drives incremental growth, while nascent display-assembly initiatives could support regional production in the medium term.

Middle East & Africa

The region’s share remains smaller but expanding, driven by renewable-energy and architectural-glass investments. GCC countries are increasingly integrating advanced optical coatings in smart-city projects, while South Africa exhibits steady demand for consumer electronics and solar glazing films.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Optical Films Market

- 3M Company

- Nitto Denko Corporation

- LG Chem Ltd.

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- Eastman Chemical Company

- Hyosung Chemical

- Zeon Corporation

- Toyobo Co., Ltd.

- Samsung SDI Co., Ltd.

- Teijin Ltd.

- KOLON Industries, Inc.

- SKC Inc.

- BenQ Materials Corp.

- Dexerials Corporation

Recent Developments

- In July 2025, 3M Company announced the expansion of its optical-film manufacturing plant in Singapore to meet growing demand for automotive and flexible display films.

- In April 2025, Nitto Denko launched a new anti-reflective, ultra-thin film designed for foldable OLED screens, improving brightness by 15% while reducing thickness by 20%.

- In February 2025, LG Chem invested USD 250 million to upgrade its polymer-film coating facilities in South Korea, enhancing production of eco-friendly and recyclable optical films.