Medical Device Labeling Market Size

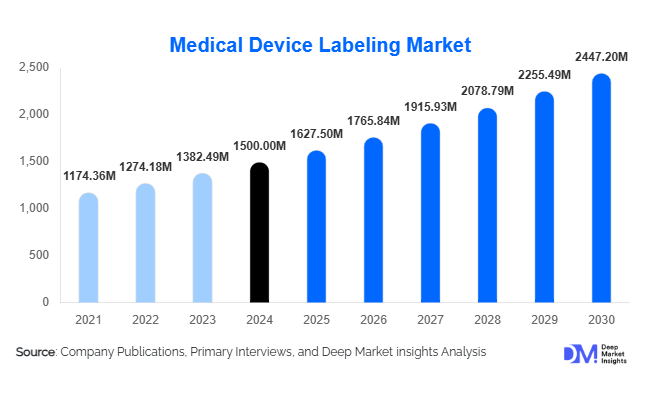

According to Deep Market Insights, the global medical device labeling market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,627.50 million in 2025 to reach USD 2,447.20 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for accurate and compliant labeling solutions, stringent regulatory frameworks for medical devices, and growing adoption of smart and digital labeling technologies across healthcare manufacturing and supply chains.

Key Market Insights

- Stringent global regulations such as EU MDR, FDA UDI, and ISO standards are significantly driving investments in compliant labeling systems for medical devices.

- Adoption of smart and digital labels, including RFID, QR codes, and NFC-enabled systems, is enhancing product traceability and patient safety.

- North America dominates the medical device labeling market, owing to its advanced healthcare infrastructure and strong regulatory oversight by the FDA.

- Europe remains a major contributor, with manufacturers adapting to MDR and IVDR compliance requirements that emphasize traceability and product lifecycle management.

- Asia-Pacific is the fastest-growing region, driven by the rapid expansion of medical device manufacturing in China, India, and Japan.

- Increasing focus on sustainable and eco-friendly labeling materials is creating opportunities for biodegradable and recyclable label innovations.

Latest Market Trends

Integration of Smart and Digital Labeling Technologies

Manufacturers are increasingly adopting smart labeling technologies such as RFID tags, NFC chips, and QR codes to enhance supply chain visibility and device authentication. These technologies enable real-time tracking and seamless data sharing between manufacturers, regulators, and end-users. Smart labels also help reduce counterfeiting, ensuring patient safety and regulatory compliance. Cloud-based labeling software integrated with enterprise systems like ERP and MES is becoming standard, supporting remote audits and digital record-keeping under regulatory scrutiny.

Eco-Friendly and Sustainable Labeling Solutions

The shift toward sustainability in healthcare packaging is influencing medical device labeling practices. Companies are adopting recyclable, low-VOC, and bio-based label materials to reduce environmental impact. Innovations such as linerless labels, solvent-free adhesives, and energy-efficient printing processes are gaining traction. Moreover, government initiatives encouraging green manufacturing are pushing suppliers to develop eco-compliant labeling solutions that align with global ESG (Environmental, Social, and Governance) goals.

Medical Device Labeling Market Drivers

Stringent Regulatory Compliance Requirements

Increasingly complex global regulations, such as the UDI system mandated by the FDA and the EU MDR, require precise and traceable labeling across all device classes. These frameworks are driving demand for automated labeling systems and validation software capable of ensuring real-time accuracy, serialization, and audit readiness. Non-compliance risks, including product recalls and fines, are compelling manufacturers to invest in advanced labeling infrastructure.

Rising Demand for Personalized and Connected Medical Devices

The growing market for personalized healthcare and wearable medical technologies is accelerating the need for dynamic, data-driven labeling solutions. Devices integrated with IoT and AI technologies require digital labeling that can update or communicate usage instructions wirelessly. As more medical devices become connected, labeling must convey real-time data, safety alerts, and device maintenance updates, creating a need for smart, interactive labeling systems.

Market Restraints

High Implementation Costs of Advanced Labeling Technologies

The transition to smart labeling systems, including RFID and digital printing, involves significant capital expenditure. Small and mid-sized device manufacturers often face budget constraints in adopting compliant, automated labeling infrastructure. In addition, training requirements and integration challenges with legacy ERP systems increase operational complexity and cost.

Regulatory Complexity and Frequent Updates

Variations in labeling regulations across regions, especially between the U.S., Europe, and Asia, create compliance challenges for global manufacturers. Constantly evolving standards, such as the EU MDR’s frequent technical documentation updates, increase the administrative burden. Delays in label validation and approval can hinder product launches and supply chain efficiency.

Medical Device Labeling Market Opportunities

Adoption of Cloud-Based Labeling Platforms

Cloud-based labeling management systems are emerging as a key opportunity for global manufacturers seeking centralized control and real-time compliance updates. These platforms enable remote validation, automatic version control, and integration with digital twins and manufacturing execution systems. Vendors offering SaaS-based labeling solutions are likely to gain a competitive advantage in global markets.

Emergence of AI-Driven Label Verification Systems

AI and machine vision technologies are being deployed to automate label inspection and verification during production. These systems ensure 100% accuracy by detecting print errors, mismatched data, and regulatory inconsistencies in real time. The integration of AI-based analytics also enables predictive maintenance of labeling equipment, reducing downtime and improving throughput.

Label Type Insights

Pressure-sensitive labels dominate the market due to their versatility and compatibility with various medical device packaging materials. Glue-applied and in-mold labels are gaining momentum in durable applications, especially for reusable instruments. RFID-enabled and smart labels represent the fastest-growing segment, driven by adoption in device tracking and authentication. Additionally, tamper-evident and multi-layer labels are becoming standard for high-value or sterile devices, enhancing product integrity and compliance assurance.

Material Insights

Polypropylene and polyester materials lead the market due to their durability, moisture resistance, and compatibility with sterilization processes. The shift toward sustainable paper-based substrates and biodegradable films is expected to grow rapidly, driven by environmental concerns and regulatory support for sustainable packaging initiatives.

| By Label Type | By Material Type | By Application | By Printing Technology |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global medical device labeling market, supported by stringent FDA UDI regulations and widespread adoption of advanced printing and inspection technologies. The U.S. is a hub for innovation in smart labeling, with increasing use of AI-enabled verification and cloud-based compliance tools.

Europe

Europe is witnessing strong growth due to the full implementation of MDR and IVDR, which require comprehensive product identification and traceability. Germany, the U.K., and France are key markets, emphasizing sustainability, data integrity, and digital labeling innovation. Partnerships between label manufacturers and device companies are expanding to ensure full compliance.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by the rapid expansion of medical device manufacturing in China, India, and Japan. Local players are investing in cost-effective, compliant labeling systems, while multinational firms are expanding production hubs in the region. The growing adoption of smart healthcare infrastructure further accelerates market growth.

Latin America

Latin America’s medical device labeling market is expanding steadily, led by Brazil and Mexico. Increasing regulatory enforcement by local health authorities, coupled with the rise in domestic medical device production, is driving demand for advanced labeling technologies and compliance software.

Middle East & Africa

The Middle East and Africa region is emerging as a niche growth market, driven by expanding healthcare infrastructure and rising imports of medical devices. The UAE and Saudi Arabia are leading the adoption of UDI-compliant labeling systems, while South Africa remains a key hub for regional distribution and labeling innovation.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medical Device Labeling Market

- CCL Industries Inc.

- Schreiner Group

- Avery Dennison Corporation

- Multi-Color Corporation (MCC)

- Denny Bros Ltd.

- Resource Label Group

- Weber Packaging Solutions

- Uhlmann Group

Recent Developments

- In August 2025, Avery Dennison introduced a new range of biodegradable medical labels designed for sustainable packaging and sterilization environments.

- In June 2025, Schreiner Group launched RFID-enabled labeling solutions tailored for surgical and diagnostic devices, improving real-time traceability.

- In March 2025, CCL Industries announced an expansion of its cloud-based labeling platform for global UDI compliance, enhancing automation and cross-border labeling standardization.