Hammock Market Size

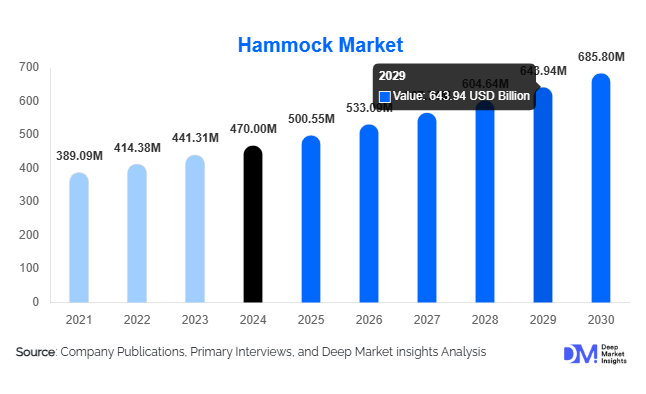

According to Deep Market Insights, the global hammock market size was valued at USD 470.00 million in 2024 and is projected to grow from USD 500.55 million in 2025 to reach USD 685.80 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is driven by the rising popularity of outdoor recreation and camping activities, increasing consumer preference for lightweight and portable relaxation furniture, and growing adoption of hammocks in urban households, resorts, and eco-tourism establishments.

Key Market Insights

- Outdoor leisure and adventure activities are the primary growth drivers, as hammocks become a staple for camping, trekking, and backyard relaxation.

- Rising urban lifestyle stress and focus on wellness have led to increased demand for home and garden hammocks for relaxation and meditation.

- Asia-Pacific dominates production due to large-scale manufacturing in China, Vietnam, and India, while North America remains the largest consumption market.

- Online retail channels are rapidly expanding, supported by e-commerce giants and direct-to-consumer hammock brands.

- Technological innovations in fabric and design—including weather-resistant, quick-dry, and ultra-light materials—are boosting product appeal.

- Eco-friendly hammocks made from recycled polyester and organic cotton are gaining traction, especially among environmentally conscious consumers.

Latest Market Trends

Rise of Sustainable and Eco-Friendly Hammocks

Manufacturers are increasingly focusing on sustainability by using organic, biodegradable, and recycled materials such as hemp, bamboo fiber, and RPET fabric. These eco-friendly hammocks appeal to environmentally aware consumers and align with global sustainability trends. Brands are also adopting low-impact dyeing processes and biodegradable packaging. Partnerships with eco-tourism lodges and green resorts are helping promote sustainable hammock models across global markets.

Smart and Multifunctional Hammock Designs

Innovation is shaping the next generation of hammocks. Emerging designs now integrate built-in shades, storage pockets, mosquito nets, and even solar-powered charging features. Lightweight collapsible frames and easy-to-assemble designs cater to modern travelers seeking portability and convenience. Smart hammocks equipped with Bluetooth speakers and ergonomic support systems are attracting younger, tech-savvy consumers.

Hammock Market Drivers

Growing Popularity of Camping and Outdoor Leisure

The boom in outdoor recreation, fueled by rising disposable incomes and a post-pandemic shift toward nature-based activities, is significantly driving hammock demand. Camping, hiking, and adventure tourism are increasingly featuring hammocks as essential gear. The affordability and easy portability of hammocks compared to traditional camping furniture make them a preferred choice among millennials and Gen Z consumers.

Expansion of E-commerce and D2C Brands

The growing penetration of e-commerce platforms such as Amazon, Decathlon, and Walmart, along with the rise of D2C hammock brands, has made these products widely accessible. Companies leverage online customization, targeted advertising, and influencer marketing to attract consumers. Subscription-based adventure gear services and online bundle offers are also boosting sales volumes globally.

Market Restraints

Seasonal Demand Fluctuations

Hammock sales are highly seasonal, with peak demand occurring during spring and summer. The dependence on outdoor activity seasons restricts consistent year-round revenue for manufacturers and retailers. In colder regions, the limited usability of hammocks during winter months poses a major growth challenge.

Low Product Differentiation and Price Competition

Due to widespread product availability and similar design offerings, many hammock brands face intense price competition. Local and unbranded players often undercut established manufacturers, reducing profit margins. Maintaining product quality while offering competitive pricing remains a key industry challenge.

Hammock Market Opportunities

Integration in Hospitality and Tourism

Luxury resorts, eco-lodges, and glamping sites are increasingly incorporating hammocks into guest accommodations, promoting them as relaxation amenities. This creates lucrative opportunities for commercial hammock suppliers. Partnerships with hospitality chains to provide custom-branded or regionally themed hammocks are becoming a growing trend in the tourism sector.

Urban and Indoor Hammock Adoption

The increasing urban focus on wellness and home décor is driving indoor hammock installations. Compact designs and hanging chair models are being integrated into living spaces, balconies, and offices. Interior designers are recommending hammocks as ergonomic and aesthetic additions for modern apartments and co-working spaces, creating new avenues beyond outdoor use.

Product Type Insights

Rope hammocks continue to dominate due to their traditional appeal and comfort, particularly in resort and home settings. Camping hammocks are the fastest-growing category, favored for portability, durability, and weather resistance. Chair hammocks and hammock stands are expanding in popularity among urban consumers who seek compact relaxation furniture. Innovation in materials such as parachute nylon and quick-dry polyester further enhances product performance and lifespan.

Distribution Channel Insights

Online retail holds the largest market share, driven by growing internet penetration and preference for doorstep delivery. E-commerce offers extensive product variety, consumer reviews, and seasonal discounts. Offline retail through specialty outdoor and sports stores remains vital, especially for premium brands emphasizing quality and experience. The integration of AR/VR product visualization tools online is improving customer engagement and boosting conversion rates.

End-User Insights

Residential consumers represent the largest end-user segment, with growing adoption in backyards, patios, and indoor spaces. Commercial users, including resorts, wellness retreats, and hospitality venues, account for a rising share as hammocks enhance relaxation aesthetics. Camping enthusiasts and adventure travelers form a fast-growing segment driven by lightweight portable hammocks designed for rugged outdoor use.

| By Product Type | By Material Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a significant share of the global hammock market, driven by a strong camping culture and an established outdoor recreation industry. The U.S. leads in both consumption and innovation, with popular brands like ENO and Wise Owl Outfitters driving market trends. The region’s focus on sustainability and wellness further fuels product demand across residential and hospitality sectors.

Europe

Europe’s hammock market is expanding steadily, supported by eco-tourism growth and the region’s emphasis on sustainable leisure products. Countries such as Germany, the U.K., and France are key markets, with rising adoption of premium and organic-fiber hammocks. The shift toward minimalist outdoor lifestyles and garden relaxation spaces continues to support growth.

Asia-Pacific

Asia-Pacific dominates global production, led by China, Vietnam, and India, due to cost-efficient manufacturing and abundant raw material availability. The region is also witnessing strong domestic demand, driven by rising middle-class incomes and increasing interest in outdoor living. Emerging local brands are expanding into export markets through e-commerce platforms.

Latin America

Latin America, particularly Brazil and Mexico, has a deep-rooted hammock culture and a growing domestic market. Handcrafted hammocks from this region are increasingly sought after in international markets for their artisanal value. Expansion of regional tourism and beach resorts is further promoting hammock adoption in commercial spaces.

Middle East & Africa

The Middle East & Africa region is witnessing moderate growth, primarily driven by increasing tourism and glamping resorts in countries like the UAE, South Africa, and Morocco. The adoption of hammocks in luxury and eco-tourism developments is supporting regional demand, while local artisans are finding export opportunities through global online marketplaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hammock Market

- Eagles Nest Outfitters (ENO)

- Therm-a-Rest

- Kammok

- Wise Owl Outfitters

- Hennessy Hammock

- Grand Trunk

- LA SIESTA

- Vivere Ltd.

Recent Developments

- In June 2025, ENO launched its EcoLoft Series, made from 100% recycled marine plastics, targeting sustainability-focused consumers.

- In April 2025, Kammok introduced a modular hammock tent system integrating weather protection and solar-powered LED lighting for campers.

- In February 2025, LA SIESTA expanded its organic cotton hammock collection in Europe, emphasizing fair-trade sourcing and eco-certification.