Golf Travel Market Size

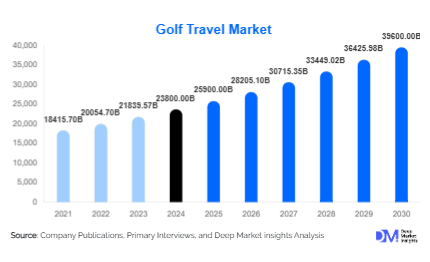

According to Deep Market Insights, the global golf travel market size was valued at USD 23,800 million in 2024 and is projected to grow from USD 25,900 million in 2025 to reach USD 39,600 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025-2030). The golf travel market growth is primarily driven by rising participation in golf worldwide, expansion of golf tourism infrastructure, increasing demand for luxury leisure experiences, and the growing appeal of international golf destinations across Europe, North America, and Asia-Pacific.

Key Market Insights

- Golf travel is evolving into a luxury leisure segment, combining premium hospitality, wellness tourism, and exclusive golf course access.

- International golf tourism is rising steadily, with Europe and North America being the largest outbound markets.

- Asia-Pacific is the fastest-growing golf travel market, driven by expanding middle-class wealth and rising golf course developments in China, Japan, Thailand, and South Korea.

- Digital adoption is transforming golf tourism, with online platforms, mobile apps, and VR-based golf course previews reshaping booking and engagement.

- Corporate and incentive golf travel is expanding, as companies integrate golf into networking, conferences, and luxury retreats.

- Tournament-driven travel, particularly around The Masters, Ryder Cup, and PGA Tour events, continues to create seasonal spikes in demand.

What are the latest trends in the golf travel market?

Luxury and Wellness-Integrated Golf Tourism

Golf tourism is increasingly merging with luxury travel and wellness experiences. Resorts are offering packages that combine championship golf courses with spas, gourmet dining, and wellness programs such as yoga retreats and holistic therapies. This hybrid positioning attracts affluent travelers and retirees seeking both relaxation and sport. The trend is especially prominent in Europe and Asia, where luxury resorts market golf as part of a broader leisure ecosystem.

Technology-Driven Golf Experiences

Technology is reshaping how golf travelers plan and experience trips. From VR previews of iconic courses to AI-powered trip customization tools, digital platforms enhance pre-travel decision-making. Mobile apps are increasingly offering real-time tee-time bookings, GPS-based course navigation, and interactive training. Augmented reality (AR) is being piloted to provide on-course tutorials, while drone-assisted course overviews are emerging as premium add-ons. Online golf travel agencies specializing in curated experiences are gaining traction, especially among younger, tech-savvy golfers.

What are the key drivers in the golf travel market?

Rising Global Golf Participation

Over 66 million people worldwide are engaged in golf, with increasing interest in markets such as China, India, and South Korea. This expanding golfer base directly fuels golf travel demand, as enthusiasts seek new destinations and premium experiences. Initiatives by golf federations and global tours to promote inclusivity and youth participation are further strengthening this driver.

Growth of International Sporting Events

High-profile tournaments such as The Masters, Ryder Cup, and PGA Tour events drive seasonal surges in golf travel. Fans, athletes, and corporate sponsors travel internationally to attend or participate, boosting local tourism economies. Hosting countries also witness long-term tourism benefits, as courses gain global visibility and prestige.

Expansion of Luxury Hospitality and Resorts

Leading hospitality groups are investing heavily in golf-integrated resorts. Destinations such as Spain, Portugal, Dubai, and Thailand are blending world-class courses with luxury accommodations and entertainment. This expansion attracts high-net-worth individuals and groups looking for exclusive leisure activities, driving steady demand.

Restraints: High Travel Costs

Golf tourism is cost-intensive, with premium course fees, international travel expenses, and exclusive resort stays. This limits access to affluent travelers, slowing adoption among middle-income groups. Seasonal fluctuations in airfare and accommodation further restrict market growth.

Restraints: Environmental and Land Constraints

Golf courses require large tracts of land and significant water resources, creating environmental sustainability concerns. Regulatory restrictions in certain regions limit new course developments, which could slow market expansion in high-demand areas.

What are the key opportunities in the golf travel industry?

Rising Demand from Emerging Markets

Asia-Pacific, particularly China, India, and Southeast Asia, represents a significant untapped opportunity. Growing middle-class populations, increasing disposable incomes, and expanding domestic tourism are fueling demand for golf travel. Governments in these regions are actively promoting golf tourism as part of broader tourism development strategies.

Corporate Incentive and Business Golf Travel

Companies are increasingly integrating golf into business networking and incentive programs. Corporate golf retreats combine leisure with professional engagements, driving demand for luxury resorts with conference facilities. This trend is especially strong in North America and Europe, but is now expanding into APAC markets.

Sustainable and Eco-Friendly Golf Tourism

Eco-conscious travelers are seeking sustainable golf tourism experiences. Resorts are investing in water-efficient irrigation systems, renewable energy, and biodiversity-friendly course designs. Courses with certifications such as GEO Certified™ are gaining popularity, creating opportunities for differentiation in an increasingly competitive market.

Product Type Insights

All-Inclusive Golf Packages dominate the market, accounting for nearly 42% of the 2024 market share, as travelers increasingly prefer bundled services covering flights, accommodation, meals, and multiple rounds of golf. Tailor-Made Packages are the fastest-growing sub-segment, appealing to affluent travelers seeking personalized itineraries with exclusive course access. Pay-as-you-go bookings, though smaller in share, remain attractive for younger golfers and budget-conscious travelers.

Traveler Type Insights

Group Golf Travelers account for around 36% of the global golf travel market in 2024, making them the largest segment. Group tours offer cost efficiency, structured schedules, and social engagement, making them particularly popular among European and Asian golfers. Corporate travelers represent a growing niche, driven by incentive travel and business networking. Solo travelers and retirees also form an important base, with strong demand for luxury wellness-integrated golf packages.

Age Group Insights

The 35-54 age group dominates the market with nearly 41% share in 2024, supported by high disposable income, professional stability, and an appetite for premium experiences. The 55+ retiree segment is expanding rapidly, driven by time availability and preference for leisure-focused travel. Meanwhile, 18-34 golfers are increasingly engaging with budget and digital-first golf travel offerings, creating a new wave of demand among younger demographics.

| By Type of Travel | By Traveler Profile | By Package Type | By Age Group | By Booking Channel | By Accommodation Type |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights North America

North America represents around 34% of the global golf travel market in 2024, led by the U.S., which hosts world-renowned courses such as Pebble Beach and Augusta. Strong participation rates, high disposable income, and major tournament-driven travel fuel the region’s dominance. Canada also contributes significantly, particularly in outbound golf tourism to Europe and Mexico.

Europe

Europe holds approximately a 31% share in 2024, with Spain, Portugal, the UK, and France emerging as leading golf travel hubs. Favorable climate, historic courses, and EU tourism initiatives support growth. The Ryder Cup and other prestigious tournaments drive strong inbound and intra-regional travel.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a projected CAGR above 11% during 2025-2030. Rising middle-class affluence in China and India, combined with established golf cultures in Japan, South Korea, and Thailand, is creating immense demand. Australia also remains a mature and high-value market.

Middle East & Africa

MEA is emerging as a luxury golf tourism destination, led by the UAE, Morocco, and South Africa. Dubai and Abu Dhabi are positioning themselves as global hubs, supported by government initiatives, world-class resorts, and year-round favorable climates.

Latin America

Latin America shows steady growth, driven by Brazil, Argentina, and Caribbean nations. Growing domestic golf tourism, rising interest in luxury golf resorts, and government support for tourism infrastructure are shaping market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Golf Travel Market

- Golfbreaks

- PerryGolf

- Premier Golf

- Your Golf Travel

- Haversham & Baker

- Carr Golf

- Golfasian

- Leading Courses

- Globus Golf

- Elite Golf Experiences

- SGH Golf

- Golf Escapes

- ScotlandGolf.com

- Golf Holidays Direct

- Premier Golf Tours

Recent Developments

- In June 2025, Golfbreaks expanded its portfolio in Spain and Portugal with new luxury all-inclusive packages focused on wellness integration.

- In April 2025, PerryGolf launched a digital platform offering VR previews of iconic golf courses, enhancing customer engagement and trip planning.

- In February 2025, Golfasian introduced eco-conscious golf packages across Thailand, with sustainable course certifications and community-based experiences.