Fall Protection Equipment Market Size

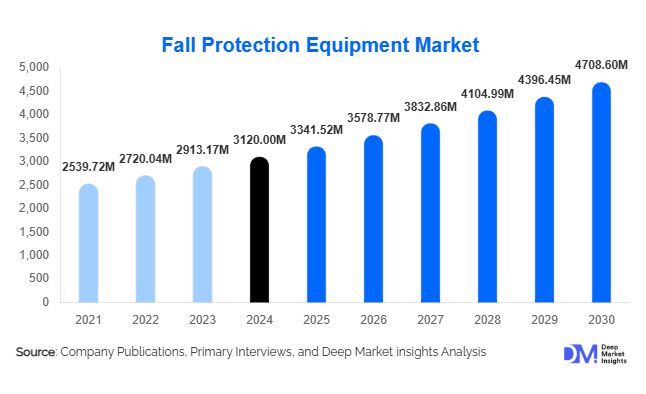

According to Deep Market Insights, the global fall protection equipment market size was valued at USD 3,120.00 million in 2024 and is projected to grow from USD 3,341.52 million in 2025 to reach USD 4,708.60 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is driven by rising regulatory enforcement of occupational safety standards, surging construction and infrastructure projects across emerging economies, and rapid adoption of smart, connected safety systems enhancing worker protection in hazardous environments.

Key Market Insights

- Regulatory enforcement across developed markets such as North America and Europe continues to mandate certified fall protection systems in construction and manufacturing sectors.

- Asia-Pacific is emerging as the fastest-growing regional market, driven by infrastructure expansion, urbanization, and industrialization in China, India, and Southeast Asia.

- Technological advancements, including IoT-enabled harnesses, connected lifelines, and real-time monitoring solutions, are redefining worker safety standards.

- Construction and manufacturing sectors dominate demand, accounting for nearly 60% of the total market revenue in 2024.

- North America leads the global market with a 29.7% share, driven by strict OSHA regulations and a mature safety culture.

- Smart and connected equipment adoption is expected to generate new revenue streams through predictive maintenance and safety analytics.

Latest Market Trends

Smart and Connected Fall Protection Systems

The integration of IoT and cloud-based monitoring into fall protection systems is transforming workplace safety. Manufacturers are launching connected harnesses and lifelines equipped with motion sensors and fall detection alerts that send real-time data to safety supervisors. These technologies enable predictive maintenance, automatic compliance logging, and faster response to incidents. Cloud analytics platforms are now being used to monitor usage patterns, ensuring that workers properly wear and maintain equipment, ultimately reducing accidents and liability risks for employers.

Growing Preference for Rental and Service Models

Small and medium-sized contractors, particularly in developing economies, are shifting toward rental and leasing models to reduce capital expenditure on fall protection gear. This trend is driving the growth of inspection, certification, and maintenance service providers. Equipment rental models are becoming popular in temporary construction and maintenance projects, where short-term or project-specific needs make ownership uneconomical. The rise of service-based models ensures recurring revenue for suppliers while improving accessibility for end-users.

Fall Protection Equipment Market Drivers

Stringent Workplace Safety Regulations

Regulatory frameworks such as OSHA (U.S.), EN 365 (Europe), and CSA (Canada) require employers to equip workers with certified fall protection gear when working above specific height thresholds. These regulations are strictly enforced, driving steady demand for certified harnesses, lifelines, and anchor systems. The increasing cost of non-compliance, including fines and insurance implications, further compels organizations to invest in high-quality safety equipment.

Infrastructure and Industrial Growth

Global construction of high-rise structures, energy installations, and industrial facilities is expanding rapidly, especially in the Asia-Pacific and the Middle East. These activities involve elevated work, boosting demand for safety systems. Investments in renewable energy infrastructure, such as wind and solar farms, are further accelerating the installation of fall protection systems for tower and rooftop maintenance workers.

Increasing Safety Awareness and Employer Liability Concerns

Organizations are increasingly prioritizing worker safety to reduce accidents and associated legal and reputational risks. The high cost of fall-related injuries has motivated industries to invest in preventive measures. Modern fall protection products, designed for comfort and ease of use, are improving compliance rates and user adoption, supporting sustained market growth.

Market Restraints

High Initial Costs in Emerging Markets

Small contractors and businesses in developing economies often face financial constraints that limit their ability to purchase certified fall protection systems. The cost of premium harnesses, anchor points, and inspection services remains high, reducing adoption rates among low-income operators and informal sectors.

Lack of Training and Poor Implementation

Improper equipment use, lack of regular inspection, and insufficient training remain major challenges in ensuring effective fall protection. Despite availability, many accidents still occur due to inadequate knowledge of installation and maintenance, reducing the overall impact of equipment adoption on worker safety outcomes.

Fall Protection Equipment Market Opportunities

Rising Enforcement of Safety Governance

Governments worldwide are strengthening occupational safety standards, offering opportunities for equipment suppliers and service providers. Mandatory safety compliance in infrastructure and industrial projects ensures sustained product demand. Companies offering certified products, inspection, and audit services can capitalize on this governance-driven growth.

Emerging Regional Markets

Developing economies in Asia-Pacific, Latin America, and Africa are undergoing rapid industrialization and urbanization, creating large-scale opportunities for fall protection manufacturers. With construction, telecom, and energy sectors expanding rapidly, there is significant potential for companies to establish local production and service hubs in these regions.

Integration of Smart Safety Technology

IoT-based smart harnesses and cloud-connected fall protection systems represent the next growth frontier. These solutions enhance safety through real-time monitoring, automated fall alerts, and data-driven compliance tracking. Manufacturers integrating analytics and wearable sensors are positioned to gain market share and achieve premium pricing.

Product Type Insights

Individual protection equipment, including full-body harnesses, lanyards, and self-retracting lifelines (SRLs), continued to dominate the fall protection equipment market in 2024, accounting for approximately 59% of total global revenue. Their widespread use across construction, manufacturing, energy, and telecommunication industries underscores their versatility and regulatory necessity in height-related operations. This dominance is reinforced by the strict enforcement of global safety regulations (OSHA, ANSI, and EN standards), which mandate the use of such equipment for all at-height work.

Technological advancements are a key growth enabler within this segment. Manufacturers are increasingly adopting lightweight composite materials, ergonomic designs, and IoT-enabled monitoring systems to enhance comfort, traceability, and compliance tracking. The integration of smart sensors within harnesses and lifelines enables real-time safety alerts and predictive maintenance, improving worker protection and operational efficiency. As industries continue prioritizing worker safety and productivity, demand for next-generation, connected personal fall protection systems is expected to rise sharply through 2030.

End-Use Industry Insights

The construction sector emerged as the leading end-use industry, contributing approximately 38.9% of the total market share in 2024. This dominance stems from the sustained expansion of global construction activity, including infrastructure megaprojects, high-rise residential towers, and commercial developments across Asia-Pacific, North America, and Europe. The sector’s reliance on elevated work platforms, scaffolding, and roofing activities makes fall protection equipment indispensable for both new construction and maintenance operations.

The manufacturing and energy industries represent the fastest-growing end-use categories, driven by rapid automation, modernization of industrial plants, and the proliferation of renewable energy projects, particularly in wind and solar power. Maintenance of elevated turbines, telecom towers, and power transmission infrastructure is creating consistent demand for advanced safety gear and anchorage systems. Additionally, ongoing global initiatives to reduce workplace accidents are compelling manufacturers to invest in certified fall arrest and restraint systems, ensuring compliance and minimizing liability risks. The integration of wearable technology and data-driven monitoring within industrial environments will further elevate adoption rates through 2030.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remained the dominant regional market in 2024, accounting for approximately 29.7% of global revenue. The United States leads the region due to stringent safety enforcement by the Occupational Safety and Health Administration (OSHA), widespread safety culture adoption, and the presence of major global manufacturers such as 3M, Honeywell, and MSA Safety. The region benefits from continuous product innovation, including smart PPE and digital compliance monitoring solutions. The Canadian market is also expanding steadily, supported by public infrastructure upgrades, pipeline maintenance, and industrial modernization programs. Key regional growth drivers include stringent workplace safety legislation, digital transformation in PPE, and public infrastructure investments exceeding USD 1 trillion under ongoing federal programs.

Europe

Europe represents a mature yet resilient market for fall protection equipment, characterized by strict regulatory standards under EN and ISO frameworks and comprehensive worker training requirements. Major markets such as Germany, the U.K., and France lead regional demand, driven by large-scale infrastructure rehabilitation projects, renewable energy expansion, and aging facility upgrades. The European Union’s emphasis on sustainability, smart manufacturing, and circular economy principles is further accelerating the adoption of environmentally responsible and durable safety systems. Moreover, the growth of industrial digitalization, supported by initiatives like “Industry 5.0” and “Fit for 55”, is spurring innovation in connected PPE and predictive safety systems. These trends collectively ensure Europe’s continued role as a technological and compliance-driven market leader.

Asia-Pacific

The Asia-Pacific (APAC) region remains the fastest-growing market for fall protection equipment, projected to record a CAGR exceeding 9% from 2025 to 2030. Rapid industrialization, urbanization, and large-scale infrastructure development in China, India, Indonesia, and Vietnam are the key demand accelerators. Significant public investments in transportation networks, industrial corridors, and renewable energy projects are increasing the need for certified fall protection systems. Government initiatives such as “Make in India” and China’s “Made in China 2025” programs are promoting worker safety compliance and domestic production of industrial PPE. Additionally, the surge in construction of telecom towers, bridges, and high-rise complexes is boosting demand for harnesses, lifelines, and anchorage devices. Rising awareness about workplace safety, coupled with the entry of international PPE manufacturers through joint ventures, further enhances regional growth prospects.

Latin America

Latin America, led by Brazil and Mexico, is experiencing steady growth in the fall protection equipment market. Increasing urban development, renewable energy expansion, and oil & gas investments are creating new safety equipment opportunities. Governments across the region are strengthening occupational safety norms and investing in worker training programs, promoting a gradual cultural shift toward proactive safety management. Market penetration, while still moderate, is rising as foreign direct investments and infrastructure projects, particularly in construction and energy, drive adoption. Regional growth drivers include expanding industrial bases, government safety campaigns, and modernization of oil extraction and construction sectors, which are collectively fostering long-term market sustainability.

Middle East & Africa

The Middle East and Africa (MEA) region is characterized by robust demand stemming from large-scale infrastructure, industrial, and oil & gas projects, especially within GCC nations such as Saudi Arabia, the UAE, and Qatar. Ongoing megaprojects, like NEOM City and extensive refinery expansions, are generating consistent requirements for certified fall arrest and restraint systems. Furthermore, government-backed initiatives such as Saudi Vision 2030 and increased public infrastructure budgets are enhancing safety compliance across sectors. In Africa, South Africa and Nigeria are key growth markets, driven by booming mining, construction, and energy industries. The region’s long-term growth is underpinned by rising occupational safety awareness, expanding industrial investments, and the gradual alignment of regional safety standards with international norms.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fall Protection Equipment Market

- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Kee Safety Inc.

- Petzl

- Werner Co.

- FallTech

- Carl Stahl GmbH

- SKYLOTEC GmbH

- ABS Safety GmbH

- Pure Safety Group Inc.

- Guardian Fall Protection

- French Creek Production

- Gravitec Systems Inc.

- Tritech Fall Protection Systems Ltd.

Recent Developments

- In August 2025, 3M introduced an IoT-enabled fall detection harness designed for predictive maintenance and real-time worker safety alerts.

- In May 2025, MSA Safety launched a connected lifeline system integrated with cloud-based analytics for the construction and wind-energy sectors.

- In February 2025, Honeywell announced the expansion of its fall protection manufacturing unit in India under the “Make in India” initiative to serve the Asia-Pacific demand.