ESD Safe Matting Market Size

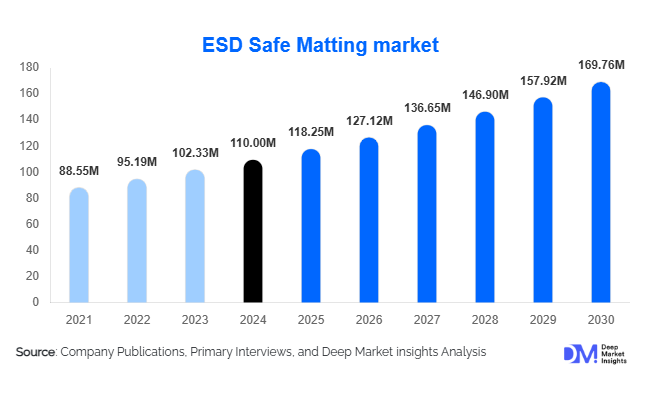

According to Deep Market Insights, the global ESD Safe Matting market was valued at USD 110 million in 2024 and is projected to grow to USD 118.25 million in 2025, reaching approximately USD 169.76 million by 2030. The market is expected to expand at a CAGR of 7.5% during the forecast period (2025–2030). The demand for ESD (Electrostatic Discharge) safe matting is driven by the rapid expansion of electronics manufacturing, the establishment of new semiconductor fabrication facilities, and growing awareness about ESD protection in cleanrooms, laboratories, and advanced industrial environments.

Key Market Insights

- Asia-Pacific leads the ESD Safe Matting market with a 40% share in 2024, supported by large-scale electronics and semiconductor manufacturing in China, India, Japan, and South Korea.

- Vinyl mats remain the dominant material segment, accounting for nearly 45% of the global market, due to cost efficiency and versatility.

- Tabletop/work-surface mats lead product demand, contributing around 35% of overall sales as ESD control becomes standard across workstations and assembly benches.

- Electronics manufacturing & assembly represent the largest end-use sector, capturing nearly half of global demand.

- Technological advancements, such as IoT-integrated “smart mats” and multi-layer static-dissipative construction, are creating premium segments within the market.

- Government initiatives promoting manufacturing localization, including “Make in India” and “Made in China 2025,” are spurring regional production of ESD control materials.

Latest Market Trends

Smart ESD Matting Systems

The integration of IoT-enabled ESD monitoring systems into matting is transforming static control practices. Advanced mats now feature embedded sensors that continuously monitor resistance and grounding conditions, transmitting data to facility management systems. This ensures compliance with standards such as ANSI/ESD S20.20 while minimizing maintenance errors. These smart mats are gaining adoption in semiconductor fabs, data centers, and high-reliability electronics assembly lines, where real-time ESD control is mission-critical.

Expansion of Cleanroom and Precision Manufacturing Applications

As industries like biotechnology, pharmaceuticals, and aerospace adopt stricter contamination and static control standards, ESD-safe matting is finding new applications beyond traditional electronics. Anti-fatigue ESD mats and multi-layer conductive flooring are increasingly specified in cleanrooms and medical device assembly environments. This diversification across sectors supports steady global growth and expands the customer base for premium-certified products.

ESD Safe Matting Market Drivers

Expansion of Electronics and Semiconductor Manufacturing

Global electronics production, driven by IoT, automotive electronics, and consumer devices, is pushing demand for ESD protection solutions. Semiconductor fabs under construction in the U.S., China, India, and Taiwan require comprehensive static control infrastructure, including workbenches and flooring mats, boosting the market’s growth trajectory.

Increasing ESD Compliance and Industry Standards

Compliance with ESD protection standards such as ANSI/ESD S20.20 and IEC 61340 is now a prerequisite in high-reliability manufacturing environments. Companies are investing in certified matting systems to reduce product failures, improve yields, and comply with global quality audits, factors driving recurring replacement and upgrade demand.

Growth in Cleanroom and Data Center Infrastructure

Rapid expansion of data centers and controlled-environment facilities across North America, Europe, and Asia-Pacific has elevated demand for ESD-safe flooring and workstation solutions. These environments require consistent grounding and anti-static safety, further broadening the adoption base for ESD-safe matting.

Market Restraints

Price Competition and Product Commoditization

Basic ESD mats, especially vinyl two-layer models, are increasingly commoditized, with intense price competition from low-cost Asian manufacturers. This challenges established players to differentiate through product innovation and service quality to sustain profitability.

Installation Complexity and Maintenance Challenges

Installing and grounding ESD matting in existing facilities can be time-consuming, leading to operational downtime. Without proper maintenance and periodic resistance checks, performance degrades, discouraging potential buyers from retrofitting or expanding matting installations.

ESD Safe Matting Market Opportunities

Geographic Expansion in Emerging Manufacturing Hubs

Emerging economies such as India, Vietnam, and Mexico are investing heavily in electronics manufacturing clusters. ESD safe matting suppliers expanding into these geographies can capture significant early-stage market share by providing localized production, faster logistics, and affordable certified solutions.

Technological Innovation and Product Diversification

Manufacturers are integrating advanced materials, multi-layer dissipative composites, anti-fatigue cushioning, and embedded resistance sensors, creating new premium product lines. The ability to deliver ergonomic comfort alongside static control differentiates leaders in this competitive market.

Expansion into Adjacent End-Use Industries

Beyond electronics, ESD-safe matting is gaining traction in pharmaceuticals, biotechnology, aerospace, and automotive electronics assembly lines. As electric vehicle production accelerates, ESD matting use across battery assembly and sensor calibration stations will offer strong growth potential for suppliers.

Product Type Insights

Among product types, tabletop/work-surface mats dominate with a 35% market share in 2024, supported by their widespread use in assembly stations and test benches. Floor mats and runners are experiencing faster growth as industries adopt full-facility ESD flooring solutions. The combination of anti-fatigue design and static-dissipative properties is creating premium demand within industrial and cleanroom settings.

Material Insights

Vinyl-based mats hold the leading position, accounting for approximately 45% of total global revenue. Their popularity stems from cost efficiency, chemical resistance, and ease of cleaning. However, rubber and composite mats are projected to grow faster (CAGR 8–9%) owing to superior durability, eco-friendly compositions, and adoption in high-reliability manufacturing zones.

End-Use Industry Insights

The electronics manufacturing and assembly sector represents the largest end-use category, contributing nearly 48% of the market in 2024. The rise of EVs, IoT devices, and miniaturized semiconductors continues to drive consistent demand. Additionally, medical device and biotechnology facilities are emerging as high-growth end-users, with cleanroom expansions accelerating across Asia-Pacific and Europe.

| By Product Type | By Application | By End-Use Industry | By Material Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global market with a 40% share in 2024, equivalent to about USD 44 million. Strong manufacturing bases in China, Japan, South Korea, and India are driving sustained demand. Government-backed semiconductor and electronics programs continue to strengthen regional leadership, while India and Vietnam exhibit the fastest growth (CAGR 8–9%).

North America

North America accounts for approximately 22% of the global market (USD 24 million). The United States leads in semiconductor expansion, supported by large-scale investment in domestic chip manufacturing. Growth in data centers and aerospace electronics sustains moderate but steady demand for ESD matting solutions.

Europe

Europe represents around 20% of global revenue (USD 22 million). Germany, the UK, and France lead adoption, driven by high-end automotive and medical device manufacturing. Retrofitting initiatives in established factories and R&D facilities maintain consistent replacement demand.

Latin America

Latin America contributes roughly 8–10% of global sales, led by Brazil and Mexico. Electronics assembly operations and new automotive plants are driving incremental growth, though overall demand remains niche compared to Asia-Pacific and North America.

Middle East & Africa

The MEA region holds a smaller but rapidly expanding share (5–6%). Investments in clean energy, aerospace, and industrial diversification (notably in Saudi Arabia and the UAE) are fueling the adoption of ESD-safe flooring in advanced manufacturing facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|