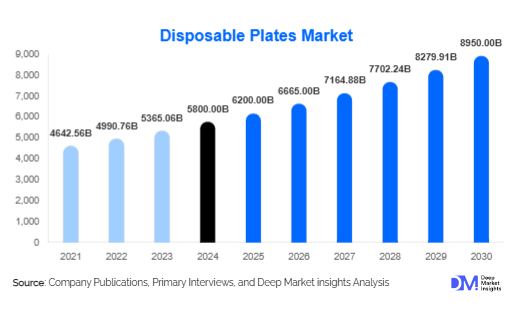

Disposable Plates Market Size

According to Deep Market Insights, the global disposable plates market size was valued at USD 5,800 million in 2024 and is projected to grow from USD 6,200 million in 2025 to reach USD 8,950 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025-2030). The disposable plates market growth is primarily driven by rising demand for convenience-oriented food packaging, strong growth in online food delivery services, and the global shift toward biodegradable and eco-friendly tableware solutions.

Key Market Insights

- Plastic plates continue to hold a significant share due to affordability and durability, but their growth is slowing due to regulatory restrictions.

- Biodegradable materials such as bagasse, palm leaf, and bamboo are gaining momentum as consumer and regulatory pressure mounts against single-use plastics.

- Foodservice is the largest end-use segment, accounting for a dominant share of global consumption in 2024.

- Asia-Pacific leads global production, while North America and Europe drive demand for sustainable product alternatives.

- E-commerce is emerging as a critical distribution channel, particularly for household and SME customers.

- Technological advancements in coating and compostability are reshaping product development strategies.

What are the latest trends in the disposable plates market?

Rapid Shift Toward Sustainable and Compostable Plates

Growing consumer awareness and government bans on single-use plastics are accelerating demand for eco-friendly alternatives such as bagasse, bamboo, and palm leaf plates. Manufacturers are expanding product portfolios with compostable and recyclable plates to align with sustainability goals. This trend is particularly strong in Europe and North America, where regulatory frameworks are driving compliance. In the Asia-Pacific, the affordability of natural raw materials such as sugarcane bagasse and bamboo provides cost advantages, making eco-friendly disposable plates more accessible.

Rising Role of Online Food Delivery and Cloud Kitchens

The surge in online food delivery platforms and cloud kitchens is a major growth catalyst for disposable plates. These businesses rely heavily on low-cost, durable, and hygienic serving options. As cloud kitchens continue expanding in urban centers across India, China, and the U.S., demand for disposable plates—particularly compartment and coated variants—is projected to rise significantly. Partnerships between plate manufacturers and food delivery aggregators are creating long-term supply opportunities.

What are the key drivers in the disposable plates market?

Growing Foodservice Industry Demand

Restaurants, quick-service outlets, and catering services are increasingly adopting disposable plates to reduce operational costs, improve hygiene, and ensure efficiency during peak demand. This sector remains the largest consumer of disposable plates, accounting for nearly 42% of global market share in 2024.

Government Push for Eco-Friendly Products

Global regulations restricting single-use plastics are driving innovation in biodegradable plate manufacturing. Policies in the European Union, Canada, and India are compelling both manufacturers and distributors to invest in eco-friendly alternatives, fueling long-term market growth.

Urbanization and Lifestyle Shifts

Increasing urban populations, rising disposable incomes, and fast-paced lifestyles are boosting household demand for convenience-driven products such as disposable plates. Rising cultural events, festivals, and outdoor dining trends further support growth in this segment.

What are the restraints for the global market?

Price Sensitivity of Eco-Friendly Alternatives

Despite growing demand, biodegradable plates are generally more expensive than plastic-based products. High production and raw material costs often limit their adoption among price-sensitive consumers and small businesses, particularly in emerging economies.

Raw Material Supply Constraints

The availability and price volatility of raw materials such as bamboo, bagasse, and cornstarch can create supply bottlenecks. Seasonal availability, climate impacts, and supply chain inefficiencies present significant challenges for consistent production and pricing stability.

What are the key opportunities in the disposable plates industry?

Expansion into Emerging Markets

Rapid urbanization and rising disposable incomes in Africa, Southeast Asia, and Latin America create strong opportunities for disposable plate manufacturers. Export-driven strategies targeting these markets can generate long-term growth.

Technological Integration in Coatings and Manufacturing

Innovations in biodegradable coatings, heat resistance, and water resistance are unlocking opportunities for premium, eco-friendly disposable plates. Manufacturers that integrate such technologies are gaining competitive advantages in high-regulation markets.

Product Type Insights

Coated disposable plates dominate the market, accounting for nearly 48% share in 2024. Their ability to resist grease and moisture makes them the preferred choice for foodservice applications. Compartment plates are gaining traction, especially in institutional and catering sectors, where portion control and convenience are critical. Uncoated plates remain popular in household applications due to affordability, but are losing share to sustainable coated alternatives.

Application Insights

Foodservice is the leading application, representing over 42% of market share in 2024. This dominance is supported by large-scale catering, restaurant chains, and quick-service outlets. Household consumption is the fastest-growing application, expected to expand at a CAGR of 8.5% from 2025-2030, driven by urban lifestyle changes and e-commerce accessibility. Institutional applications such as schools, hospitals, and offices are also witnessing steady growth, supported by government contracts and bulk procurement.

Distribution Channel Insights

Supermarkets and hypermarkets are the largest distribution channels, accounting for around 38% of sales in 2024. However, online/e-commerce platforms are the fastest-growing channel, expanding at a projected CAGR of 9% during 2025-2030. Foodservice distributors maintain steady demand through bulk supply contracts with restaurants and institutional buyers, while wholesale clubs continue to thrive in North America and Europe.

| By Material Type | By Product Type | By Size | By Application / End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market share in 2024, with the U.S. being the primary consumer. The region’s growth is fueled by strict bans on plastic plates and increasing adoption of compostable alternatives. Institutional demand from schools and hospitals is especially strong.

Europe

Europe held 25% of the global market share in 2024. The region is leading in biodegradable plate adoption due to strict EU regulations. Germany, the UK, and France are the largest markets, with growing emphasis on carbon-neutral supply chains and recycling.

Asia-Pacific

Asia-Pacific is the largest production hub and the fastest-growing consumer market. China and India dominate demand, supported by abundant raw materials and a booming foodservice industry. APAC is projected to grow at a CAGR of 8.2% during 2025-2030.

Latin America

Latin America is emerging as a growing market, led by Brazil and Mexico. Rising disposable incomes and the expansion of quick-service restaurants are fueling demand, although plastic still dominates due to affordability.

Middle East & Africa

MEA markets such as Saudi Arabia, UAE, and South Africa are witnessing steady growth. High event-driven consumption and government sustainability initiatives are driving the adoption of eco-friendly alternatives in premium consumer segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Disposable Plates Market

- Dart Container Corporation

- Huhtamaki Oyj

- Georgia-Pacific LLC

- Eco-Products Inc.

- Vegware Ltd.

- Biopac UK Ltd.

- Genpak LLC

- CKF Inc.

- World Centric

- Natural Tableware

- BioPak

- Anchor Packaging Inc.

- Karatzis Group

- Duni AB

- Pactiv Evergreen Inc.

Recent Developments

- In June 2025, Huhtamaki announced a new line of compostable coated paper plates designed to replace polyethylene-coated alternatives across Europe.

- In May 2025, Dart Container expanded its bagasse plate production facility in the U.S. to meet rising demand from foodservice distributors.

- In March 2025, Vegware introduced biodegradable compartment plates aimed at institutional buyers, particularly in the education sector.