Children Day Care Services Market Size

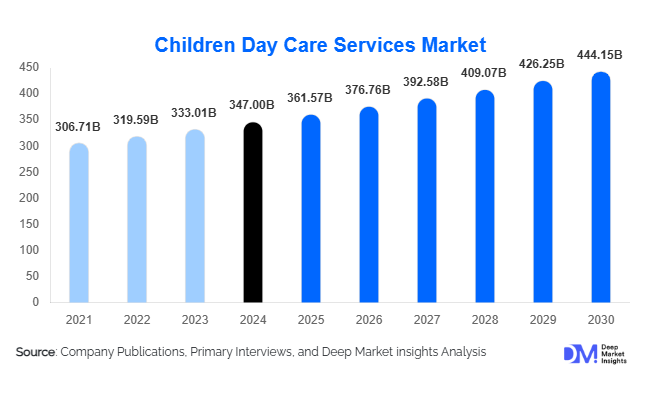

According to Deep Market Insights, the global children day care services market size was valued at USD 347 billion in 2024 and is projected to grow from USD 361.57 billion in 2025 to reach USD 444.15 billion by 2030, expanding at a CAGR of 4.2% during the forecast period (2025–2030). Market growth is driven by the rising participation of women in the workforce, a growing number of dual-income households, and increased awareness of the importance of early childhood education and structured day care programs.

Key Market Insights

- Center-based day care services dominate the market, accounting for more than 60% of global revenue in 2024 due to their structured environments and professional management.

- Preschool-age care (3–5 years) represents the largest age segment, comprising approximately 44% of total enrolments as parents increasingly prioritize school-readiness programs.

- Private paying households drive roughly three-fourths of global demand, highlighting sustained consumer spending on early childhood care.

- North America leads the market, representing around 42% of global revenue in 2024, followed by Asia-Pacific as the fastest-growing region with a CAGR exceeding 6%.

- Technology integration in day care services, including mobile monitoring, digital attendance, and e-learning interfaces, is transforming parental engagement and operational efficiency.

- Public–private partnerships and government subsidies are expanding access to affordable care, particularly in emerging economies.

Latest Market Trends

Digital and Smart Day Care Models

Child care providers are adopting digital tools such as mobile apps for real-time updates, online enrolment systems, and developmental tracking dashboards. These technologies enable transparency for parents and improve administrative efficiency. Integration of CCTV access, AI-based learning recommendations, and data-driven child development monitoring is redefining premium day care services. This digital shift also supports hybrid models combining in-center care with virtual early-learning content, appealing to tech-savvy millennial parents.

Expansion in Emerging Economies

Rapid urbanization, rising household incomes, and government-backed child care initiatives are fuelling expansion in Asia-Pacific, Latin America, and the Middle East. Countries such as India and China are witnessing large-scale investment in early childhood infrastructure, including franchised chains and community-based centers. Governments are offering tax credits and subsidies to encourage participation, leading to the formalization of what were historically informal child care networks. These developments are expected to double day care penetration rates across many emerging economies by 2030.

Children Day Care Services Market Drivers

Increasing Female Workforce Participation

The steady rise in global female labor force participation is the primary driver of market expansion. With more dual-income families, professional day care facilities have become a necessity rather than a luxury. Developed economies have established standards and subsidies to ensure access, while emerging markets are rapidly building formal capacity to meet new demand.

Rising Awareness of Early Childhood Development

Growing recognition of the importance of early learning outcomes and school readiness is increasing parental preference for structured and curriculum-based care. Governments and NGOs are supporting quality frameworks for early education, and private operators are incorporating educational programs, STEM exposure, and language development modules within their care models.

Government Subsidies and Public–Private Initiatives

Global policy emphasis on family welfare and gender equality is resulting in subsidies, tax credits, and child care grants that reduce household cost burdens. Partnerships between public agencies and private providers are creating scalable, regulated infrastructures that ensure both affordability and quality. These factors have significantly increased enrolment rates in several OECD and developing nations.

Market Restraints

Operational and Staffing Challenges

Providers face high operational costs due to mandatory staff–child ratios, regulatory compliance, and qualified caregiver shortages. Rising wage inflation and training costs have tightened margins, while uneven regulatory frameworks complicate international expansion. Maintaining quality while ensuring profitability remains a challenge for small and medium operators.

Infrastructure and Real Estate Constraints

High urban property costs and facility standards restrict rapid expansion, particularly in dense metropolitan regions. Operators struggle to find affordable locations that meet safety and space requirements, slowing new center openings. In emerging economies, underdeveloped infrastructure and licensing barriers further limit formal capacity growth.

Children Day Care Services Market Opportunities

Technology-Enabled Care Services

Integrating digital platforms for scheduling, parent communication, and child monitoring provides differentiation and scalability. Smart day care models enhance trust and engagement, with AI-assisted learning progress reports and cloud-based documentation simplifying compliance. This is an opportunity for both established providers and new tech-driven entrants.

Expansion into Underserved Regions

Emerging markets in Asia, the Middle East, and Latin America remain largely under-penetrated. Governments are allocating funds for early education infrastructure, while private operators are exploring franchise-based expansions. With increasing urbanization and a growing young population, these regions represent the highest potential for new capacity creation over the next five years.

Flexible and Hybrid Care Models

As hybrid and remote work reshape parental needs, demand for flexible care, including drop-in, part-day, and after-school options, is growing. Operators offering adaptive schedules, emergency or weekend care, and employer-sponsored programs can tap into evolving workforce dynamics, especially in technology and service sectors.

Segment Insights

By Service Type

Center-based day care remained the dominant segment in 2024, accounting for approximately 62% of the global market share. This dominance is attributed to structured learning environments, certified staff, and established safety protocols that foster parental trust. The segment also benefits from economies of scale and strong brand recognition among large operators, allowing for standardized curriculum delivery and quality assurance across facilities. Technological integration, including digital attendance tracking and parent communication platforms, has further strengthened service efficiency and transparency, reinforcing the appeal of center-based care. With the increasing participation of women in the workforce and the rising emphasis on early childhood development, this segment is expected to maintain its lead position through 2030.

By Age Group

The preschool care (3–5 years) segment led with around 44% share of the global market in 2024. This growth is underpinned by the global focus on school readiness and holistic early education. Governments and private institutions are increasingly integrating play-based curricula and accredited programs that enhance cognitive, social, and emotional development. Rising parental awareness of the long-term educational benefits of early learning and the proliferation of pre-kindergarten programs in both developed and emerging economies continue to drive this segment. The demand for certified preschool teachers and the expansion of blended learning models combining traditional teaching with digital learning tools are also key accelerators for this category’s growth.

By End User

Private-paying households represented the largest end-user group, contributing approximately 75% of total global revenue in 2024. This dominance reflects higher disposable incomes among dual-income families and growing acceptance of formal day care as an essential support for working parents. The trend is particularly strong in urban regions of North America, Europe, and the Asia-Pacific, where parents prioritize structured developmental care and safety standards over informal arrangements. In emerging economies, rising affordability, government subsidies, and expanding access to quality facilities are enabling middle-income households to participate in formal childcare systems. The sustained rise in urban employment and corporate-sponsored childcare initiatives will continue to support strong private household participation through 2030.

End-Use Insights

Demand for children's day care services remains concentrated among working parents, both dual-income and single-parent households, who require dependable, full-day or extended-hour programs. The most significant growth is being recorded in employer-sponsored childcare programs and after-school services, which address the increasing demand for flexible and convenient solutions. Large corporations across sectors such as IT, healthcare, and finance are increasingly investing in on-site childcare as a strategic initiative to improve employee retention, productivity, and diversity inclusion. Furthermore, the integration of early education modules with daycare operations is giving rise to hybrid models that offer both developmental learning and supervision within one framework. These models are gaining popularity in urban centers globally, where parents seek educational enrichment alongside safe childcare options. With continued growth in professional female employment and corporate welfare initiatives, demand from enterprise-linked childcare is projected to accelerate throughout the forecast period.

| By Age Group | By Ownership Type | By End Use | |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominated the global children's day care services market in 2024, capturing approximately 42% share (valued at around USD 140 billion). The United States remains the principal market, supported by a well-established institutional framework, a high female workforce participation, and strong public-private collaboration in early childhood education. Federal programs such as the Child Care Development Block Grant (CCDBG) and employer tax incentives for dependent care contribute to sustained market demand. The region’s growth is further driven by increasing corporate-sponsored childcare, the rise of professional franchise networks, and technological advancements in safety and communication systems. Canada also demonstrates strong momentum, propelled by universal childcare funding policies and robust provincial support, making North America a consistently mature yet expanding region in this sector.

Europe

Europe accounted for a roughly 28% share (USD 95 billion) in 2024, led by the United Kingdom, Germany, and France. The market benefits from comprehensive government subsidies, universal early education mandates, and parental leave reforms that encourage formal childcare usage. EU directives on affordable access to quality early education and the expansion of cross-border education standards have enhanced consistency across member states. Demand is further reinforced by the region’s aging population and high female labor participation, which together sustain strong institutional enrollment. Increasing investments in green and sustainable childcare centers, along with digital learning integration, are positioning Europe as a leader in innovative, inclusive early education systems.

Asia-Pacific

The Asia-Pacific region represented about 30% of the global market (USD 100 billion) in 2024 and is projected to record the fastest growth, with a CAGR exceeding 6% through 2030. China and India are spearheading this expansion due to rapid urbanization, increasing dual-income families, and government-backed early childhood education policies such as India’s National Education Policy (NEP) 2020 and China’s childcare infrastructure investments. Franchise-led international early learning brands are proliferating across Australia, Singapore, and Malaysia, enhancing the availability of high-quality services. The region’s growth drivers include rising awareness of child development, expanding corporate childcare partnerships, and strong support for working mothers. Technological adoption, such as mobile-based parent communication tools and e-learning integrations, is also amplifying efficiency and market scalability across the Asia-Pacific.

Latin America

In Latin America, the market accounted for approximately 8% share in 2024, with Brazil and Mexico emerging as key contributors. Economic recovery, increasing female employment, and growing urban middle-class populations are supporting demand for structured childcare services. The region is witnessing gradual formalization as governments introduce early education policies and subsidies for low-income families. Brazil’s National Education Plan and Mexico’s early learning reforms are enhancing institutional childcare access. However, informal care arrangements remain common in rural areas. Market growth is further driven by urban investments in preschool infrastructure, the rise of private childcare chains, and partnerships with NGOs focusing on early cognitive development.

Middle East & Africa

The Middle East & Africa (MEA) region represented roughly 5–7% of global market revenue in 2024. Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, including the UAE, Saudi Arabia, and Qatar, where governments are actively promoting women’s participation in the workforce through national transformation programs. This has spurred the establishment of high-quality private and corporate childcare centers aligned with Vision 2030 initiatives. In Africa, rising urbanization and collaboration with international NGOs are improving access to early learning infrastructure. Countries such as South Africa, Kenya, and Nigeria are experiencing expanding childcare service networks due to education reforms and donor-funded preschool projects. Across the region, market growth is being accelerated by public-private partnerships, workforce policy reforms, and the introduction of global education franchises catering to expatriate and urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Children Day Care Services Market

- Bright Horizons Family Solutions

- KinderCare Learning Centers

- G8 Education

- Learning Care Group

- Busy Bees Daycare

- Cadence Education

- The Learning Experience

- Spring Education Group

- Kids ‘R’ Kids International

- Goddard Systems

- Founding Years Learning Solutions Pvt Ltd

- Global Children’s Center

- Tiny Hoppers Corp.

- KLA (KU Children’s Services)

- Primrose School Franchising Co.