Artificial Nails Market Size

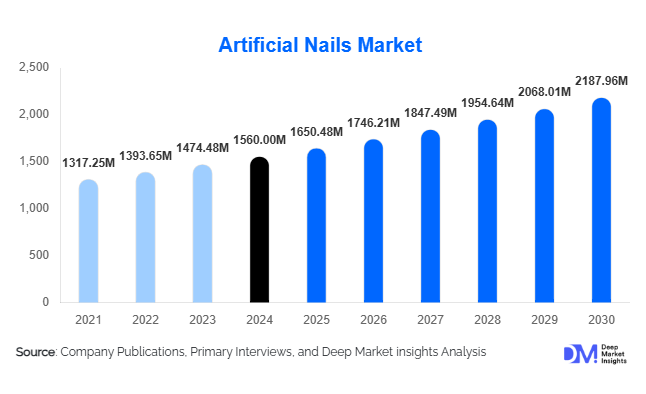

According to Deep Market Insights, the global artificial nails market size was valued at USD 1,560.00 million in 2024 and is projected to grow from USD 1,650.48 million in 2025 to reach USD 2,187.96 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). This growth is primarily driven by the rising popularity of at-home nail enhancement kits, continuous innovations in gel and acrylic systems, and increasing demand for affordable, aesthetic beauty solutions across emerging and developed markets.

Key Market Insights

- Press-on nails dominate the market due to their ease of use, affordability, and growing preference for quick DIY beauty applications.

- Acrylic nails remain the most widely used material type, holding approximately 30% market share owing to their durability and long-lasting finish.

- Online retail is the fastest-growing distribution channel, driven by influencer marketing, social media exposure, and direct-to-consumer models.

- Home-use kits are witnessing rapid adoption, with DIY consumers contributing nearly 40% of market revenue in 2024.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, expanding salon networks, and beauty-conscious millennial populations.

- Eco-friendly and reusable nail systems are emerging trends, reflecting consumer demand for sustainable beauty solutions.

Latest Market Trends

DIY and At-Home Nail Enhancements Rising Rapidly

A major trend transforming the artificial nails market is the surge in do-it-yourself (DIY) beauty practices. Consumers are increasingly purchasing press-on nails and gel kits online, drawn by affordability, convenience, and variety. Brands have responded by launching reusable, pre-glued press-ons and simplified home-application gels that mimic salon-quality results. Social media tutorials and influencer content have made self-applied nail art mainstream, particularly among younger demographics. Subscription-based nail boxes and augmented-reality (AR) try-on tools are further personalizing the DIY nail experience, expanding the consumer base beyond traditional salon customers.

Eco-Friendly and Non-Toxic Nail Innovations

Growing consumer awareness of chemical safety and sustainability is reshaping the artificial nails industry. Manufacturers are increasingly introducing biodegradable nail wraps, odor-free acrylics, and non-toxic gel formulations. Reusable press-on nails are reducing waste, while recyclable packaging and water-based adhesives are gaining traction. The sustainability shift not only appeals to environmentally conscious consumers but also aligns with tightening cosmetic safety regulations, especially in Europe. As a result, “clean beauty” brands are emerging as key disruptors within the artificial nails market, commanding premium price points and loyal followings.

Artificial Nails Market Drivers

Rising Beauty Consciousness and Fashion Influence

Global consumer awareness of nail aesthetics, amplified by celebrity culture and social media platforms such as Instagram and TikTok, is fueling market demand. Artificial nails have evolved from occasional accessories into fashion statements that reflect personal style. Constant exposure to nail art trends online has made nail customization an everyday beauty choice, spurring both salon and DIY consumption.

Growth of At-Home and Direct-to-Consumer Channels

E-commerce platforms and direct-to-consumer (D2C) brands are transforming product accessibility. The COVID-19 pandemic accelerated at-home beauty routines, creating sustained demand for press-ons and gel kits. Consumers now prefer brands offering easy application, fast delivery, and online tutorials. D2C models enable higher margins for manufacturers and direct customer engagement, making online retail one of the most dynamic growth channels in the market.

Material and Technology Advancements

Innovations in nail technology, such as LED-curable gels, flexible polymers, and lightweight dip powders, are improving product quality, durability, and comfort. Technological integration through AR and AI try-on apps allows consumers to visualize nail styles before purchase, enhancing the shopping experience. These innovations broaden market appeal across diverse demographics, reinforcing brand differentiation.

Market Restraints

Health and Maintenance Concerns

Prolonged use of certain artificial nail systems can cause natural nail weakening, allergic reactions, or fungal infections. The requirement for professional removal of acrylics or gels and potential exposure to harsh chemicals discourages some consumers. Regulatory scrutiny on nail adhesives and monomers also poses compliance challenges for manufacturers.

Price Sensitivity and Intense Competition

In mature markets, the artificial nails industry faces pricing pressures due to abundant low-cost imports and short product life cycles. Premium salon services are costly, while DIY kits compete in a price-sensitive consumer segment. This dual dynamic compresses profit margins, especially for mid-tier brands lacking strong differentiation or brand equity.

Artificial Nails Market Opportunities

Expansion into Emerging Economies

Asia-Pacific, the Middle East, and Latin America are witnessing rapid growth in beauty spending, providing fertile ground for artificial nail brands. Companies can capture share by localizing product designs, offering affordable kits, and leveraging local influencers. Collaborations with regional salon chains can also enhance brand visibility and market penetration.

Technological Integration and Smart Customization

AR and AI-powered tools are enabling personalized nail recommendations based on skin tone, nail length, and style preferences. Virtual try-on apps and 3D printing of custom nail sets are redefining consumer interaction. These innovations create value-added experiences and open new revenue streams for digital-first nail brands.

Sustainable and Health-Conscious Product Development

Clean, vegan, and cruelty-free artificial nail products are becoming mainstream. Brands emphasizing sustainability through recyclable materials, low-VOC adhesives, and reusable nail sets are tapping into a fast-growing niche. As regulations tighten and eco-conscious consumerism expands, sustainability-focused products will command premium pricing and market preference.

Product Type Insights

Among product types, press-on nails lead the global artificial nails market, accounting for approximately 35% of total revenue in 2024. Their dominance is attributed to the strong consumer shift toward convenience, affordability, and rapid application, especially within younger, digitally active demographics. The rise of reusable and pre-designed press-on systems has made them particularly appealing for at-home users seeking instant transformations without salon visits. Improved adhesive technologies, fashion collaborations, and the ability to easily switch designs for different occasions are key factors driving adoption. Furthermore, social media trends and influencer promotions have amplified awareness, fueling repeat purchases and cross-category experimentation. This category’s growth is further enhanced by the increasing penetration of direct-to-consumer (D2C) brands offering subscription boxes and limited-edition styles.

Gel nails follow closely, supported by their superior aesthetic finish and quick-curing characteristics through UV/LED lamps. Consumers perceive gel nails as providing a glossier and more natural look than acrylic alternatives, while salons favor them for faster service turnaround. Gel nails are particularly gaining traction in fashion-forward markets such as Japan, South Korea, and Western Europe, where premium consumers emphasize long-lasting yet breathable finishes. Acrylic nails retain a solid position, especially among professional users, due to their unmatched durability and sculpting flexibility, ideal for long wear and custom designs. Meanwhile, dip powder nails are expanding rapidly, valued for low odor, extended wear time, and minimal UV exposure, making them popular among health-conscious users. The niche fiberglass and silk wrap segment continues to serve clients seeking thin yet reinforced overlays that provide strength without bulk.

Material Insights

Acrylic-based systems continue to dominate the material landscape, representing around 30% of the global market in 2024. Their proven performance in delivering customizable lengths and shapes, combined with durability, sustains demand among professional salons. However, the segment faces competition from gel-based materials, which are gaining share due to their superior shine, odor control, and eco-friendly formulations. Dip powder systems have also gained traction as hybrid solutions, offering the strength of acrylics with a lighter texture and simplified application suitable for both salons and home users. Rising concerns about harsh chemicals and allergenic components have prompted ongoing product reformulations, leading to increased investment in bio-based and non-toxic materials. This aligns with tightening cosmetic safety standards in Europe and growing consumer preference for sustainable beauty solutions worldwide.

Distribution Channel Insights

The online retail channel has become the fastest-growing distribution segment, contributing nearly 25% of global sales in 2024. The surge in e-commerce adoption, combined with social media marketing and influencer collaborations, has redefined how artificial nail products are discovered and purchased. Consumers increasingly prefer shopping directly through brand websites, online marketplaces, and subscription models that provide seasonal updates or trend-based collections. This growth is further supported by high engagement on platforms like TikTok and Instagram, where tutorials and user-generated content drive awareness and sales. Meanwhile, salon and professional distributors continue to hold a significant share by catering to bulk buyers and maintaining exclusivity agreements with major nail brands. Specialty beauty retailers and pharmacies offer credibility and trial-based purchase experiences, while mass-market channels such as supermarkets remain crucial for impulse and repeat purchases at accessible price points.

End-User Insights

The home-use or DIY segment leads the artificial nails market, capturing approximately 40% of the 2024 global revenue. This trend is driven by affordability, convenience, and the increased availability of professional-quality DIY nail kits and reusable press-ons. Consumers are increasingly confident in self-application due to the proliferation of online tutorials, influencer endorsements, and improved at-home product safety. The rise of e-commerce and subscription-based models has further democratized access to high-quality nail products. In contrast, the professional salon segment remains vital for premium applications, custom art, and long-lasting finishes. Salons also serve as key brand ambassadors, offering experiential marketing and training opportunities that sustain demand for high-margin professional-grade systems. Both end-user categories are expected to coexist strongly, with DIY gaining volume dominance and salons maintaining high value share.

| By Product Type | By Material Type | By Application / End-user | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for roughly 35% of global market share in 2024, solidifying its position as the largest regional market for artificial nails. The region’s growth is propelled by high disposable income, a well-established salon culture, and strong penetration of online marketplaces. The United States is the dominant contributor, driven by heavy influence from celebrity trends, influencer marketing, and social media aesthetics promoting nail artistry as part of self-expression. A growing number of professional training programs and salon franchising networks further strengthen the market structure. Canada is seeing steady expansion in both premium salon services and DIY home kits, while Mexico’s demand is being shaped by increasing urbanization and cross-border beauty trends. The region’s focus on innovation, coupled with sustainability concerns, has encouraged the introduction of vegan and cruelty-free nail systems, enhancing product diversity and long-term growth potential.

Europe

Europe holds approximately 25% of the global market in 2024, led by Germany, the U.K., France, and Italy. The region’s growth is anchored in its mature salon infrastructure and stringent cosmetic safety regulations, which drive demand for high-quality, low-toxicity formulations. Regulatory pressures, particularly under the EU Cosmetics Directive, have prompted continuous product innovation and reformulation toward cleaner ingredient profiles. Consumers in Europe also show a strong inclination toward professional-grade, eco-certified brands and recyclable packaging, aligning with regional sustainability goals. Educational programs promoting nail health and professional training standards further support product credibility. The premium segment thrives as European customers are willing to pay for superior safety and craftsmanship, while mid-tier segments benefit from growing demand in Central and Eastern European markets.

Asia-Pacific

Asia-Pacific (APAC) emerged as the fastest-growing region globally, capturing around 31% of the total market in 2024. The region’s dynamism is fueled by rapid urbanization, the influence of K-beauty and J-beauty trends, and a fashion-conscious youth population. Consumers in China, Japan, South Korea, and India are increasingly embracing nail aesthetics as a form of self-expression, with frequent product launches and seasonal trends driving repeat purchases. The region also hosts some of the largest manufacturing bases for artificial nails, contributing substantially to global exports. Local brands are innovating rapidly in trendy formats such as intricate gel designs, press-ons, and peel-off systems. E-commerce platforms like Taobao, Rakuten, and Shopee are pivotal in connecting domestic producers with international buyers. Rising disposable incomes and social media exposure continue to position APAC as the global epicenter of nail art innovation.

Latin America

Latin America represented approximately 10% of the global artificial nails market in 2024, led by Brazil, Argentina, and Mexico. The region’s market expansion is underpinned by rising beauty spending, informal salon ecosystems, and growing youth-driven fashion trends. Brazilian consumers, in particular, demonstrate a strong preference for vibrant colors and long-lasting finishes suited to humid climates. Social media and influencer-led beauty movements are also shaping demand patterns, especially among urban millennials. Despite moderate price sensitivity, the mid-tier segment is growing due to consumers seeking durability without premium pricing. Informal salons and small retailers dominate distribution, though online sales are beginning to gain traction through cross-border platforms. As beauty awareness and consumer sophistication rise, Latin America presents untapped potential for both international and local nail brands.

Middle East & Africa

The Middle East & Africa (MEA) collectively accounts for around 8–10% the global artificial nails market share. Growth in this region is fueled by premiumization trends in GCC nations, notably the UAE and Saudi Arabia, where consumers prioritize luxury salon experiences and long-lasting systems suited to hot, arid climates. High disposable incomes, combined with cultural acceptance of nail enhancement as part of beauty rituals, support steady growth. The expansion of high-end beauty salons and luxury malls has created a strong retail infrastructure for international brands. In contrast, several African markets are characterized by informal channels and cost-sensitive consumers, with locally produced, affordable nail products gaining traction. The region’s increasing participation in global fashion and social media spaces is expected to sustain long-term demand, particularly for press-ons and gel-based solutions adapted to regional climate conditions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artificial Nails Market

- KISS Products Inc.

- Hand & Nail Harmony Inc.

- Dashing Diva

- Young Nails Inc.

- Naio Nails

- Anise Cosmetics LLC

- Beauty 21 Cosmetics Inc.

- Sheba Nails Inc.

- Nailene Inc.

- OPI

- CND (Creative Nail Design)

- Makartt

- Mia Secret

- NAILS Inc.

- Gelish

Recent Developments

- In June 2025, KISS Products launched a biodegradable press-on nail line targeting eco-conscious consumers in North America and Europe.

- In April 2025, Dashing Diva introduced a customizable AR-powered nail design app enabling consumers to preview nail styles before purchase.

- In February 2025, Hand & Nail Harmony expanded its gel manufacturing facility in California to meet growing U.S. and APAC demand.