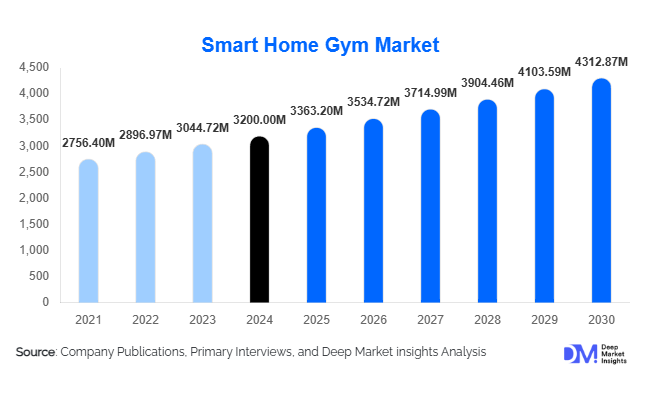

According to Deep Market Insights, the global smart home gym market size was valued at USD 3,200.00 million in 2024 and is projected to grow from USD 3,363.20 million in 2025 to reach USD 4,312.87 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030).The market growth is primarily driven by increasing consumer adoption of AI-enabled fitness equipment, rising awareness of health and wellness, and the convenience offered by home-based workouts that integrate virtual coaching and connected fitness platforms.

Smart Home Gym Market Size

Key Market Insights

- Smart home gyms are increasingly integrating AI and virtual coaching, providing personalized training plans, performance tracking, and interactive experiences that enhance user engagement.

- Residential adoption is driving demand globally, supported by post-pandemic lifestyle changes, growing urbanization, and a preference for home-based fitness solutions.

- North America dominates the smart home gym market, led by high disposable incomes, tech-savvy consumers, and a strong fitness culture.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes in China and India and increasing health consciousness.

- Connected fitness platforms and subscription-based virtual training models are reshaping the market by offering interactive and community-driven experiences.

- Technological integration, including IoT connectivity, AI-powered personalization, and virtual reality-based workouts, is driving product differentiation and competitive advantage.

What are the latest trends in the smart home gym market?

AI and Virtual Coaching Integration

Smart home gym equipment increasingly leverages artificial intelligence and machine learning to provide personalized workout plans and adaptive training. Virtual coaching enables users to receive real-time guidance, performance analysis, and feedback, enhancing motivation and adherence to fitness routines. Platforms are incorporating AI-driven content recommendations and gamification elements to sustain engagement. The trend caters to tech-savvy consumers seeking immersive, data-driven fitness experiences without the need for in-person gym access.

Connected Fitness Platforms

Subscription-based connected fitness platforms are becoming central to the smart home gym ecosystem. Users access live or on-demand classes, community challenges, and progress tracking through integrated apps, which foster user loyalty and recurring revenue streams for providers. This trend also enables global reach, allowing companies to expand into emerging markets with digital-first strategies while offering scalable, personalized fitness solutions.

What are the key drivers in the smart home gym market?

Rising Health Awareness and Wellness Trends

Increasing awareness of the benefits of regular physical activity and mental well-being has fueled demand for home-based fitness solutions. Consumers are seeking integrated fitness experiences that combine exercise, health monitoring, and wellness guidance, driving adoption of smart gym equipment that offers holistic support and connectivity.

Technological Advancements

Innovation in AI, IoT, sensor technologies, and VR-based training has enhanced product functionality, enabling personalized, interactive, and data-driven fitness experiences. These technological advancements differentiate products, increase user engagement, and support higher adoption rates in competitive markets.

Shift to Home-Based Workouts

The COVID-19 pandemic accelerated the preference for exercising at home, highlighting convenience, flexibility, and privacy. Smart gym equipment allows users to maintain structured fitness routines without traveling to traditional gyms, driving sustained growth in the residential segment.

What are the restraints for the global market?

High Initial Investment Costs

The upfront cost of smart gym equipment can be a barrier for many consumers, particularly in price-sensitive markets. While the long-term benefits are significant, the initial investment limits adoption and slows market penetration among mid-income users.

Technical Challenges and Maintenance

Complex technologies in smart gym equipment can lead to operational issues and require maintenance support. Ensuring reliability, firmware updates, and customer service is critical to maintaining consumer trust and sustaining long-term growth.

What are the key opportunities in the smart home gym market?

Expansion into Emerging Markets

Asia-Pacific and Latin America present significant growth opportunities due to rising disposable incomes, urbanization, and increasing health consciousness. Companies can leverage localized marketing strategies and affordable product offerings to capture untapped consumer segments.

Partnerships with Health and Wellness Platforms

Integrating smart gym equipment with digital health platforms, wellness apps, and virtual training communities can enhance user engagement and provide holistic fitness experiences. Partnerships facilitate cross-promotional opportunities and boost brand loyalty.

Innovation in Connected Fitness Technologies

Investment in AI, VR, and IoT-enabled fitness devices enables differentiated product offerings. Companies can capitalize on trends such as gamified workouts, real-time performance tracking, and social connectivity to attract tech-oriented users and drive recurring revenue models.

Product Type Insights

Cardiovascular training equipment, such as smart treadmills and exercise bikes, leads the market, accounting for a significant share due to high consumer adoption and integration of heart rate monitoring, virtual classes, and AI coaching. Strength training equipment, including smart dumbbells and resistance machines, is gaining popularity for home-based strength programs. Connected fitness platforms are increasingly central, offering subscription-based virtual workouts and interactive training experiences.

Application Insights

Residential users dominate demand for smart home gym equipment, followed by fitness enthusiasts and rehabilitation centers. The fastest-growing applications are personalized home workouts, rehabilitation programs, and interactive virtual classes, expanding the market beyond traditional gym users.

Distribution Channel Insights

Direct-to-consumer online platforms, brand websites, and connected fitness subscriptions dominate sales channels. Retail and specialty stores cater to offline buyers, while digital channels support subscription models, app-based experiences, and real-time customer engagement. Social media marketing and influencer campaigns increasingly influence purchasing decisions.

End-Use Insights

Residential end-users account for the largest share of the smart home gym market, driven by convenience, personalized workouts, and cost savings. Commercial applications in fitness centers and rehabilitation clinics are expanding, particularly with AI-enabled and connected training devices. Export-driven demand is rising from North America and Europe to emerging markets in the Asia-Pacific, boosting market penetration globally.

Product Type Insights

Cardiovascular training equipment, such as smart treadmills and exercise bikes, leads the market, accounting for a significant share due to high consumer adoption and integration of heart rate monitoring, virtual classes, and AI coaching. Strength training equipment, including smart dumbbells and resistance machines, is gaining popularity for home-based strength programs. Connected fitness platforms are increasingly central, offering subscription-based virtual workouts and interactive training experiences.

Application Insights

Residential users dominate demand for smart home gym equipment, followed by fitness enthusiasts and rehabilitation centers. The fastest-growing applications are personalized home workouts, rehabilitation programs, and interactive virtual classes, expanding the market beyond traditional gym users.

Distribution Channel Insights

Direct-to-consumer online platforms, brand websites, and connected fitness subscriptions dominate sales channels. Retail and specialty stores cater to offline buyers, while digital channels support subscription models, app-based experiences, and real-time customer engagement. Social media marketing and influencer campaigns increasingly influence purchasing decisions.

End-Use Insights

Residential end-users account for the largest share of the smart home gym market, driven by convenience, personalized workouts, and cost savings. Commercial applications in fitness centers and rehabilitation clinics are expanding, particularly with AI-enabled and connected training devices. Export-driven demand is rising from North America and Europe to emerging markets in the Asia-Pacific region, boosting market penetration globally.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. and Canada leading demand for smart home gyms. High disposable incomes, tech-savvy consumers, and widespread fitness culture contribute to 38% of the global market in 2024. Connected platforms and premium equipment drive adoption.

Europe

Europe accounts for approximately 27% of the 2024 market, with Germany, the U.K., and France as leading countries. Health consciousness and digital adoption support steady growth, particularly in mid-range and high-end smart gym equipment.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rising middle-class incomes, urbanization, and increasing fitness awareness are driving rapid adoption of connected and affordable smart gym solutions.

Latin America

Brazil, Argentina, and Mexico show moderate growth, driven by emerging fitness culture and increasing awareness of smart home gym solutions.

Middle East & Africa

While nascent, the region shows potential with rising health awareness, infrastructure improvements, and affluent populations in the UAE and Saudi Arabia adopting premium smart gym equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Note: The above countries are part of our standard off-the-shelf report, we can add countries of your interest

Regional Growth Insights Download Free Sample

Key Players in the Smart Home Gym Market

- Peloton

- NordicTrack

- Bowflex

- Mirror

- Echelon

- ProForm

- Technogym

- Life Fitness

- Precor

- Tonale

- JAXJOX

- Hydrow

- FitnessAI

- Core Fitness

- MYXfitness

Recent Developments

- In May 2025, Peloton launched a new AI-powered treadmill integrating personalized coaching and virtual reality workouts, enhancing user engagement.

- In March 2025, NordicTrack introduced a connected strength training system with adaptive resistance and virtual group classes, targeting the growing residential segment.

- In January 2025, Echelon expanded its connected fitness platform to the Asia-Pacific region, offering localized content and subscription-based virtual workouts.

Frequently Asked Questions

How big is the smart home gym market?

According to Deep Market Insights, the global smart home gym market size was valued at USD 3,200.00 million in 2024 and is projected to grow from USD 3,363.20 million in 2025 to reach USD 4,312.87 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030).

What are the key opportunities in the market?

Expansion into emerging markets, integration with digital health platforms, and AI/VR-enabled connected fitness solutions are the primary growth opportunities.

Who are the leading players in the market?

Peloton, NordicTrack, Bowflex, Mirror, Echelon, ProForm, Technogym, Life Fitness, Precor, and Hydrow are the leading global players.

What are the factors driving the growth of the market?

Rising health awareness, technological advancements in AI and IoT, and the shift toward home-based workouts are driving market growth.

Which are the various segmentations that the market report covers?

Which are the various segmentations that the market report covers?