Marine Waterproof Floodlight Market Size

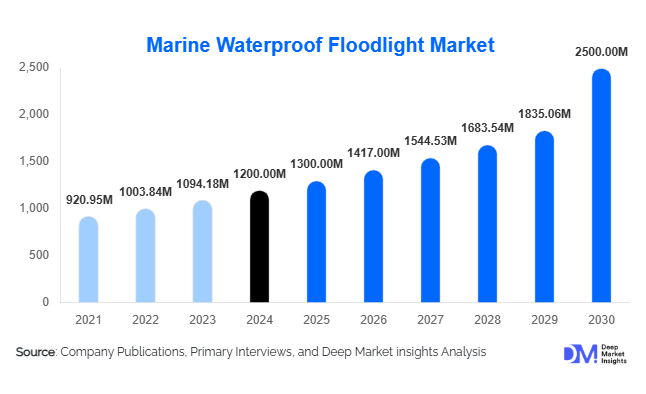

According to Deep Market Insights, the global marine waterproof floodlight market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,300 million in 2025 to reach USD 2,500 million by 2030, expanding at a CAGR of 9% during the forecast period (2025–2030). The market growth is primarily driven by rising maritime trade, expansion of port and offshore infrastructure, increasing adoption of energy-efficient LED lighting, and growing demand in recreational boating and luxury yachts.

Key Market Insights

- LED floodlights dominate the market due to superior energy efficiency, longer life, corrosion resistance, and lower maintenance costs compared to halogen or metal halide options.

- Asia-Pacific is a leading region, driven by extensive shipbuilding in China, port expansion in India and Southeast Asia, and growing offshore oil, gas, and renewable energy installations.

- North America remains a major market, with strong demand from commercial shipping fleets, recreational boating, and stringent maritime safety regulations.

- Smart and IoT-enabled marine floodlights are gaining traction, offering remote monitoring, adaptive lighting, and energy optimization for vessels and offshore structures.

- Retrofit demand for aging vessels and port facilities provides a large growth opportunity, particularly in Europe and North America.

- Government infrastructure investments in coastal protection, ports, and maritime safety projects are increasing the adoption of durable waterproof floodlighting solutions.

What are the latest trends in the marine waterproof floodlight market?

Shift Toward LED and Energy-Efficient Solutions

Marine operators are increasingly adopting LED floodlights due to their energy efficiency, long operational lifespan, and reduced maintenance requirements. These lights offer better performance under harsh marine conditions, including vibration, saltwater exposure, and UV radiation. The shift to LED technology is supported by sustainability goals, rising electricity costs, and stricter environmental regulations. Additionally, manufacturers are introducing high-lumen, corrosion-resistant LED models, which allow for improved illumination of decks, ports, and offshore structures while maintaining operational cost efficiency.

Smart and IoT-Enabled Floodlighting

Technological integration is shaping the marine floodlight market, with smart lighting solutions allowing remote monitoring, adaptive brightness, motion sensing, and predictive maintenance. Vessels and port authorities can now monitor light performance in real time, detect failures early, and optimize energy usage. Integration with vessel automation systems and offshore platform control networks enhances operational safety. This trend appeals to shipbuilders, offshore operators, and recreational yacht owners looking for high-performance, low-maintenance, and intelligent lighting solutions.

What are the key drivers in the marine waterproof floodlight market?

Expansion of Maritime Infrastructure

Global maritime trade growth is driving port and harbor expansion, offshore platform development, and coastal facility modernization. These infrastructures require durable, high-intensity, waterproof floodlights for safety, navigation, and operational efficiency. The increase in cargo volumes and ship traffic necessitates adequate illumination for loading, unloading, and night operations, directly boosting market demand.

Rising Adoption of LED Technology

LED floodlights are replacing conventional halogen and metal halide lighting due to lower energy consumption, longer life, and higher reliability under marine conditions. This trend is reinforced by regulations encouraging energy efficiency and sustainability, particularly in Europe and North America. LED adoption is also supported by the need for low-maintenance solutions for vessels, ports, and offshore installations.

Regulatory Compliance and Safety Standards

International and national maritime regulations, including IMO safety standards and environmental directives, mandate reliable lighting for vessels, ports, and offshore structures. Compliance requirements for waterproofing, corrosion resistance, and hazardous location ratings drive demand for certified, high-quality marine floodlights. Buyers increasingly prefer lights that meet or exceed IP ratings and safety certifications.

What are the restraints for the global market?

High Upfront Costs

Despite long-term energy savings, marine-grade waterproof floodlights require a higher initial investment due to robust materials, specialized sealing, and certification processes. Small vessels and low-income regions often face budget constraints, limiting market penetration and slowing adoption rates.

Harsh Environmental Challenges

Marine environments are highly corrosive, with saltwater, UV exposure, vibration, and extreme weather affecting lighting durability. Even high-quality products may require frequent inspection and maintenance, creating operational challenges and increasing lifecycle costs. These environmental factors act as a restraint on market growth.

What are the key opportunities in the marine waterproof floodlight industry?

Retrofit of Aging Vessels and Ports

Older ships, commercial fleets, and port facilities are increasingly being retrofitted with LED and smart waterproof floodlights to improve energy efficiency, reduce maintenance costs, and meet modern safety standards. This creates a significant market opportunity, especially in North America, Europe, and the Asia-Pacific region, where infrastructure modernization is a priority.

Growth in Recreational Boating and Luxury Yachts

The expansion of leisure boating, marine tourism, and luxury yacht ownership is driving demand for aesthetically designed, high-performance floodlights. Buyers in this segment seek durable, energy-efficient lights with smart features, color customization, and aesthetic appeal, creating a lucrative niche for premium products.

Technology Integration and Smart Lighting

Marine floodlights equipped with IoT connectivity, adaptive brightness, motion sensors, and remote monitoring provide operational efficiency and safety advantages. Manufacturers investing in R&D for smart, corrosion-resistant, and energy-efficient lighting solutions are well-positioned to capitalize on this growing trend.

Product Type Insights

LED floodlights dominate the market, accounting for approximately 55% of the 2024 market share, due to their energy efficiency, long lifespan, and suitability for harsh marine environments. Halogen and metal halide lights are gradually being phased out in favor of LEDs. The trend toward LED adoption is most pronounced in commercial shipping fleets, ports, offshore platforms, and luxury yachts, driven by cost savings, regulatory compliance, and performance benefits.

Application Insights

Port and harbor lighting remains the leading application segment, representing nearly 35% of the 2024 market. These environments require high-intensity, waterproof lighting for safety, navigation, and operational efficiency. Offshore oil & gas platforms and renewable energy installations are rapidly growing applications, driven by safety requirements and harsh environmental conditions. Recreational boats, yachts, and marine tourism facilities are emerging as high-growth niche applications, focusing on aesthetics, energy efficiency, and smart lighting integration.

Distribution Channel Insights

Marine waterproof floodlights are primarily distributed through OEMs, specialized marine equipment dealers, and direct sales to ports and offshore operators. E-commerce platforms are gaining popularity, particularly for recreational and aftermarket buyers. OEMs supply vessels during manufacturing or retrofit, while distributors and dealers handle smaller-scale installations and maintenance. Direct partnerships with port authorities and offshore operators remain key for high-volume, certified installations.

End-Use Insights

Commercial vessels and port authorities dominate the end-use market, while recreational boating and luxury yachts represent high-growth segments. Offshore oil, gas, and renewable energy platforms require specialized floodlighting solutions, contributing to market expansion. Export-driven demand is notable from Asia-Pacific and Europe, supplying high-quality waterproof floodlights to emerging maritime markets worldwide.

| By Product Type | By Mounting / Installation | By Application / End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 33% of the 2024 market, led by the U.S. and Canada. Strong demand is driven by commercial shipping fleets, recreational boating, and strict maritime safety regulations. Retrofit of aging vessels and port modernization projects are key growth drivers. The U.S. is the fastest-growing market within the region due to infrastructure investment and the adoption of smart lighting solutions.

Europe

Europe holds nearly 23% of the 2024 market. Germany, the U.K., and the Netherlands lead demand due to strict safety and environmental regulations, port modernization, and offshore wind farm development. Scandinavia is a high-growth sub-region, driven by renewable energy projects and advanced shipbuilding capabilities.

Asia-Pacific

Asia-Pacific is a major growth hub, contributing 34% of the market in 2024. China, India, South Korea, and Japan lead demand through shipbuilding, port expansion, offshore oil & gas, and recreational boating. India and Southeast Asia are the fastest-growing markets, fueled by infrastructure investments and increasing maritime trade.

Latin America

Latin America accounts for 6% of the market, with Brazil and Mexico leading growth. Port modernization, fishing fleet upgrades, and rising recreational boating are key drivers, although economic and infrastructure challenges limit overall penetration.

Middle East & Africa

This region contributes 4% of the global market. UAE, Saudi Arabia, and South Africa are major demand centers, driven by port expansion, offshore oil & gas operations, and high-income recreational boating. GCC countries are the fastest-growing sub-region due to luxury marine infrastructure and investment in coastal safety projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Marine Waterproof Floodlight Market

- Hella Marine

- Foresti & Suardi

- Bluefin LED

- Lumitec

- Perko

- VETUS

- AAA Worldwide Enterprises

- PLASTIMO

- Xylem

- Eval

- Den Haan Rotterdam

- Maritime Lighting Solutions

- OceanLED

- Attwood Marine

- Light & Motion Marine

Recent Developments

- In May 2025, Hella Marine launched a series of smart LED floodlights with IoT connectivity for commercial vessels and offshore platforms, enhancing energy efficiency and remote monitoring capabilities.

- In April 2025, Lumitec introduced corrosion-resistant, high-lumen floodlights for recreational yachts, featuring color-adjustable LED options and extended operational lifespan.

- In February 2025, Foresti & Suardi expanded its global footprint by supplying certified waterproof floodlights to new port modernization projects in India and Southeast Asia.