Intelligent Parcel Locker Market Size

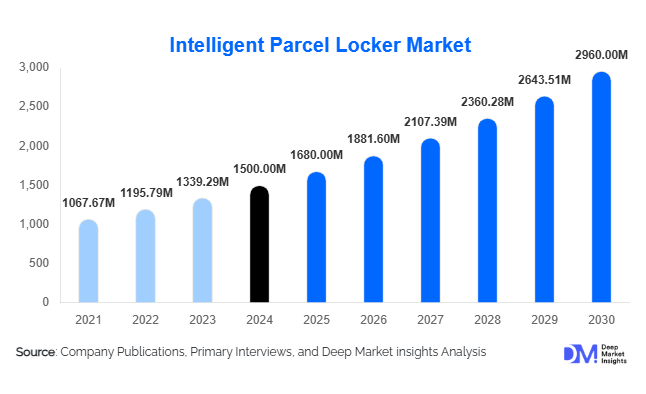

According to Deep Market Insights, the global intelligent parcel locker market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,680 million in 2025 to reach USD 2,960.73 million by 2030, expanding at a CAGR of 12% during the forecast period (2025–2030). The market growth is primarily driven by the rapid expansion of e-commerce, rising demand for contactless last-mile delivery solutions, and increasing adoption of smart, IoT-enabled, and modular locker systems in residential, commercial, and public infrastructure applications.

Key Market Insights

- Hardware continues to dominate revenue share, with modular and temperature-controlled lockers gaining traction due to scalability and specialized delivery needs.

- Indoor deployments remain the leading installation type, particularly in residential and commercial complexes, due to lower cost, protection from weather, and ease of maintenance.

- North America holds the largest regional share, led by the U.S., driven by dense urban populations, high e-commerce penetration, and smart city initiatives.

- Asia-Pacific is the fastest-growing region, with India and China showing strong demand for residential, retail, and logistics-related locker systems.

- E-commerce companies, retailers, and logistics providers dominate end-use adoption, accounting for nearly 45% of the 2024 market share.

- Technological integration, including IoT connectivity, AI analytics, mobile apps, and temperature-controlled features, is transforming the industry and creating opportunities for recurring software and service revenue.

What are the latest trends in the intelligent parcel locker market?

Specialized & Value-Added Lockers

Locker providers are increasingly offering temperature-controlled units for groceries, pharmaceuticals, and perishable deliveries, as well as weatherproof and vandal-resistant solutions for outdoor installations. Modular designs allow scalability in high-demand urban areas and flexibility in commercial and logistics hubs. Integration of advanced authentication methods, mobile apps, and IoT monitoring has become standard, enhancing user convenience and operational efficiency. These value-added solutions enable differentiation, premium pricing, and expansion into new end-use industries.

Software-Driven Services and Locker-as-a-Service Models

While hardware dominates revenue, software platforms, predictive maintenance, and subscription-based Locker-as-a-Service models are rapidly growing. Companies are offering cloud-enabled management, real-time tracking, mobile notifications, and analytics for operational optimization. This shift provides recurring revenue streams, improves customer stickiness, and allows integration with e-commerce platforms to optimize last-mile logistics. Predictive analytics and AI enable dynamic allocation of locker capacity and improved delivery success rates, positioning software and services as key growth levers.

What are the key drivers in the intelligent parcel locker market?

Growth of E-Commerce and Last-Mile Delivery Needs

The surge in e-commerce shipments globally has put enormous pressure on last-mile delivery networks. Intelligent parcel lockers reduce failed deliveries, enhance delivery efficiency, and provide consumers with 24/7 pickup and drop-off options. High-volume residential complexes, office buildings, and retail hubs are increasingly deploying lockers to handle growing parcel volumes efficiently, making this a core market driver.

Rising Demand for Contactless Delivery Solutions

Post-pandemic consumer preferences favor contactless interactions, increasing the adoption of parcel lockers. Lockers improve security, convenience, and hygiene by minimizing human contact during deliveries. This trend spans both residential and commercial installations, driving global market growth.

Technological Advancements and Smart Integration

Innovations in IoT, AI, mobile apps, and cloud-based platforms enhance the functionality of intelligent lockers. Features like temperature control, predictive maintenance, smart access authentication, and modular expansion increase adoption across various sectors. Technology also enables better integration with e-commerce platforms, logistics networks, and property management systems, further supporting market growth.

What are the restraints for the global market?

High Capital and Maintenance Costs

Installation of advanced locker systems, especially outdoor or temperature-controlled units, requires significant capital expenditure and ongoing maintenance. These costs can deter small businesses and limit deployment in cost-sensitive regions, restraining market expansion.

Regulatory, Security, and Data Privacy Concerns

Connected locker systems must comply with electrical, building, fire safety, and data protection regulations. Cybersecurity threats and concerns about theft or vandalism also create adoption barriers. Compliance costs and the need for secure software infrastructure can slow market growth, particularly in emerging regions with evolving standards.

What are the key opportunities in the intelligent parcel locker industry?

Smart City and Urban Infrastructure Integration

Government-backed smart city initiatives offer opportunities to integrate locker networks into public transport hubs, commercial centers, and residential complexes. Public-private partnerships enable faster deployment and cost-sharing, allowing locker providers to scale quickly while aligning with urban development policies and sustainability goals.

Expansion into Specialized Applications

Temperature-controlled lockers for healthcare, food delivery, and pharmaceuticals, as well as solar-powered outdoor lockers, present high-value opportunities. These specialized solutions command premium pricing and allow companies to enter new verticals, including healthcare logistics, food distribution, and pharmaceutical supply chains.

Software and Managed Services Adoption

As lockers become increasingly connected, recurring revenue opportunities arise through subscription-based software, remote monitoring, predictive maintenance, and integration with e-commerce and logistics platforms. Providers can upsell analytics, dynamic allocation, and enhanced security features, driving both profitability and market penetration.

Product Type Insights

Modular parcel lockers dominate the market due to their scalability, flexibility, and lower total cost of ownership. Standalone lockers and specialized units, including temperature-controlled systems, are gaining share as e-commerce, grocery, and pharmaceutical deliveries increase. Modular designs are preferred in residential and commercial deployments because they allow incremental expansion based on demand, ensuring optimal utilization of floor space and reduced capital expenditure risk.

Application Insights

Commercial and corporate buildings account for the largest share of locker deployments globally, driven by the high volume of deliveries in office complexes and multi-tenant buildings. Residential multi-family housing is the fastest-growing application, reflecting increasing urbanization and demand for secure, convenient parcel handling. Logistics hubs and retail click-and-collect points are also expanding rapidly, leveraging lockers to optimize last-mile delivery and enhance customer experience.

Distribution Channel Insights

Direct sales to end-users, including e-commerce platforms, property developers, and logistics companies, dominate the distribution channel. Partnerships with real estate developers and logistics integrators are increasingly common, while online platforms for ordering lockers or maintenance services are emerging. Subscription-based and managed service models are gaining traction, providing recurring revenue and deeper integration with customer operations.

End-User Insights

E-commerce companies, retailers, and logistics providers are the largest end-users, accounting for nearly 45% of market share in 2024. Residential multi-family complexes and commercial office buildings are growing rapidly, reflecting urbanization trends and corporate adoption. Healthcare and food delivery sectors represent emerging end-use opportunities, particularly for temperature-controlled and specialized lockers.

Age Group Insights

While intelligent parcel lockers are not age-specific in usage, younger and middle-aged urban populations (18–50 years) are the primary users, leveraging mobile apps for notifications and contactless access. This demographic drives adoption in residential complexes, offices, and commercial areas, supporting market growth and encouraging innovative features.

| By Product Type | By Installation Type | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest regional market, with the U.S. leading adoption due to high e-commerce penetration, dense urban populations, and smart city programs. Canada is also contributing, particularly in major metropolitan areas. North American demand is strong for indoor and modular lockers, primarily in commercial and residential applications, accounting for ~34–37% of the global market in 2024.

Europe

Europe holds ~25–30% of the market, led by Germany, the UK, and France. Strong urban logistics demand, supportive regulations, and sustainability-focused initiatives are driving adoption. Northern and Western Europe emphasize smart, connected, and eco-friendly lockers, while Eastern Europe is emerging as a high-growth region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. High urbanization, rapid e-commerce growth, and smart city policies are fueling demand. China leads in large-scale locker installations, while India is expanding adoption in residential and retail sectors. Specialized applications, including temperature-controlled lockers, are increasing rapidly in this region.

Latin America

Brazil and Mexico are key markets in Latin America, with growing e-commerce penetration driving locker adoption. Infrastructure and cost considerations limit broader deployment, but the market is gradually expanding through retail and residential applications.

Middle East & Africa

Gulf countries such as the UAE and Saudi Arabia are emerging as important markets due to high-income populations and luxury retail adoption. South Africa leads African demand, primarily in urban centers and commercial hubs. Smart city and infrastructure projects in the region are further accelerating adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Intelligent Parcel Locker Market

- Quadient (Parcel Pending)

- TZ Limited

- KEBA AG

- Ricoh Group

- Cleveron

- Luxer Corporation

- Florence Corporation

- Hollman Inc.

- Zhilai Tech

- Pitney Bowes Inc.

- My Parcel Locker

- Parcel Port Solutions

- Smartbox Ecommerce Solutions

- Shenzhen Zhilai Sci & Tech Co.

- Lockerpoint

Recent Developments

- In March 2025, Quadient expanded its modular locker installations across U.S. residential and commercial complexes, integrating AI-powered predictive analytics for parcel demand.

- In January 2025, Cleveron launched new temperature-controlled lockers in Europe for grocery and pharmaceutical deliveries, enhancing cold chain capabilities.

- In February 2025, KEBA AG partnered with Asian e-commerce platforms to deploy smart locker networks in China and India, supporting last-mile delivery efficiency and contactless access.