Furniture Rental Service Market Summary

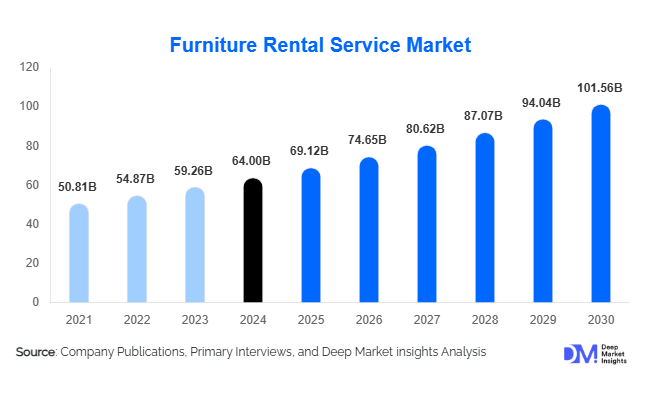

According to Deep Market Insights, the global furniture rental service market size was valued at USD 64.0 billion in 2024 and is projected to grow from USD 69.12 billion in 2025 to reach USD 101.56 billion by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The furniture rental service market is experiencing growth primarily driven by increasing urbanization, rising demand for flexible and subscription-based living solutions, growth in corporate temporary housing, and the growing popularity of circular and sustainable consumption models.

Key Market Insights

- Residential furniture rental is the dominant segment, catering to students, young professionals, and urban nomads seeking flexible living solutions without the burden of ownership.

- Corporate housing and B2B contracts are expanding, providing stable recurring revenue streams for operators through temporary employee relocation and project-based accommodations.

- North America and APAC are key markets, with North America leading in ARPU and APAC showing the fastest percentage growth due to rising urban rental populations and middle-class expansion.

- Technology-enabled platforms are transforming the market, improving inventory management, dynamic pricing, logistics efficiency, and customer experience.

- Sustainability and refurbishment practices are gaining prominence, creating value through circular business models and longer asset lifecycles.

- Event and hospitality rentals remain high-margin verticals, with growing opportunities in staging, exhibitions, and film/TV production.

What are the latest trends in the furniture rental service market?

Subscription-Based and Long-Term Rentals Dominating

Operators are increasingly shifting toward subscription-based and long-term rental models. Contracts ranging from 12 months or more are capturing a higher lifetime value per customer due to predictable revenue streams and lower churn rates. Residential and corporate customers favor these flexible models, which allow frequent upgrades, reduce upfront capital expenditure, and align with evolving urban lifestyles. Operators are also offering modular, fully furnished packages that simplify moving and optimize refurbishment cycles, enhancing asset utilization and operational efficiency.

Technology-Driven Platforms Enhancing Customer Experience

Technology adoption is transforming the furniture rental experience. Digital platforms enable direct-to-consumer subscriptions, seamless order management, and integration of logistics and refurbishment tracking. IoT-enabled furniture, predictive asset maintenance, and AI-powered pricing optimize utilization and profitability. Mobile apps offer real-time tracking, subscription management, and curated furniture selections, appealing to tech-savvy urban renters. Platforms integrating embedded financing, insurance, and flexible bundles are driving higher customer retention and faster market scalability.

What are the key drivers in the furniture rental service market?

Urbanization and Flexible Living Preferences

Rapid urbanization, rising rental housing, and a growing population of young professionals are driving demand for furniture rental services. Consumers increasingly prioritize flexibility, convenience, and cost savings over ownership. Subscription-based and modular furniture packages allow seamless relocation and lifestyle adaptability, making rental services particularly appealing in densely populated urban areas. The trend toward minimalism and shared living models further accelerates adoption, especially in APAC and North American cities.

Growth of Corporate Housing and Project-Based Rentals

Corporate mobility, temporary projects, and relocation requirements are fueling B2B demand. Companies prefer single-vendor solutions for turnkey furnished accommodations, resulting in higher average contract values and long-term recurring revenue. This segment is particularly lucrative as it minimizes operational risk for operators while delivering consistent demand, with North America and Europe accounting for a significant share of corporate rental revenues.

Enhanced Logistics and Refurbishment Capabilities

Advances in warehouse management, delivery logistics, and refurbishment processes have reduced operational costs and improved furniture utilization. Asset-light marketplaces and platform-based operations allow scaling with lower capital expenditure. Companies leveraging predictive maintenance, refurbishment scheduling, and technology-enabled customer interfaces achieve higher margins and better customer satisfaction, driving overall market growth.

What are the restraints for the global market?

High Capital and Operational Intensity

Furniture rental is a capital-intensive business requiring significant investment in inventory, warehousing, logistics, and refurbishment infrastructure. New entrants face challenges in achieving economies of scale, and operational inefficiencies can quickly erode margins. Depreciation and maintenance costs further complicate profitability, particularly for small and mid-sized operators.

Fragmented Market and Regional Regulatory Complexities

The furniture rental market is highly fragmented with numerous regional and local operators. Varying regulations on product safety, import duties, and refurbishment standards across countries complicate cross-border scaling. Fragmentation limits pricing power and requires operators to invest heavily in customer acquisition, logistics, and compliance, potentially slowing market expansion.

What are the key opportunities in the furniture rental service industry?

Expansion in Corporate and B2B Housing Contracts

Securing corporate contracts for employee relocation, project teams, and temporary accommodations provides stable revenue streams. Large enterprises increasingly outsource housing and furniture provisioning to single vendors, creating opportunities for operators to offer bundled packages, flexible subscription terms, and integrated logistics services.

Platform-Based and Technology-Integrated Models

Leveraging digital platforms for D2C subscriptions, asset-light marketplaces, and integrated logistics allows operators to scale efficiently. Embedding financing, insurance, and refurbishment workflows within platforms enhances customer experience and operational efficiency, unlocking new markets for urban and SME renters.

Emerging Markets and Regional Growth in APAC

Rising urbanization, middle-class expansion, and short-term rental demand in India, China, and Southeast Asia provide significant growth potential. Operators focusing on modular product lines, low-cost refurbishment, and partnerships with real-estate developers can capture large market share while optimizing costs. Export opportunities for refurbished inventories further enhance profitability.

Sustainability and Circular Economy Initiatives

Consumers increasingly value refurbished and circular furniture offerings. Operators implementing lifecycle management, refurbishment, resale, and donation programs can differentiate themselves, attract eco-conscious customers, and command premium pricing.

Product Type Insights

Living room furniture, particularly sofas and couches, continues to dominate the furniture rental market due to its high value, frequent rental cycles, and versatility across both residential and corporate applications. Bedroom and dining sets follow closely, with modular and multi-purpose items gaining traction for their adaptability in small urban apartments and co-living setups. Office and co-working furniture rentals are expanding significantly, driven by the hybrid work trend and the increasing demand for temporary office setups, allowing businesses to scale quickly without large capital expenditures. Event and hospitality rental furniture represents a high-margin segment, with short-term rentals catering to weddings, exhibitions, corporate events, and film/TV productions, reflecting both flexibility and customization requirements.

Application Insights

Residential furniture rental remains the largest application segment, catering to students, young professionals, and temporary urban residents. The primary driver is the flexibility and cost-effectiveness it provides, particularly in high-cost urban centers. Corporate and project-based rentals are the fastest-growing application, fueled by HR mobility, employee relocation, and temporary office projects. Hospitality and event rentals remain high-margin applications, driven by short-term but premium demand for customizable and stylish furniture solutions. Emerging applications include co-living arrangements, short-term vacation rentals, and film/TV production setups, which are niche yet increasingly lucrative due to rapid turnover and specialized requirements.

Distribution Channel Insights

Direct-to-consumer (D2C) digital platforms dominate furniture rental bookings, offering convenience, transparent pricing, and streamlined subscription management. B2B contracts with corporates, property managers, and event organizers contribute substantially to revenue streams, particularly for long-term or bulk rentals. Online marketplaces and rental aggregators enable wider customer reach and cross-regional expansion, while physical rental stores serve local demand and enable immediate fulfillment. The adoption of technology—including mobile apps, AI-enabled logistics, predictive maintenance, and refurbishment scheduling—enhances operational efficiency, optimizes asset utilization, and improves customer retention.

End-User Insights

Urban residential customers account for the largest user base, driven by the need for affordable, flexible, and space-saving furniture solutions in cities with high living costs. Corporate clients represent a high-value segment due to long-term contracts, bulk orders, and project-based requirements, particularly in North America and Europe. Hospitality and event organizers constitute another growing segment, especially in regions with a thriving event industry. Emerging end-users include co-living operators, short-term vacation rental hosts, and film/TV production companies seeking temporary furniture setups for short-duration projects.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30–36% of the global furniture rental market, led by the U.S. and Canada. Key regional drivers include increasing urbanization, the proliferation of minimalist lifestyles in major cities like New York and Los Angeles, and corporate relocation and temporary housing demands. High disposable incomes and strong infrastructure for logistics and refurbishment support large-scale adoption. Established operators such as CORT and Rent-A-Center dominate, providing reliable inventory management, high ARPU, and premium service levels. The residential segment is driven by the flexibility and affordability it offers urban renters, while corporate rentals benefit from growing workforce mobility and project-based office setups.

Europe

Europe holds around 12–18% of the global market, with Germany, the U.K., and the Nordics leading adoption. Strong sustainability awareness and eco-conscious living trends are key growth drivers, encouraging consumers to prefer rental models over ownership to reduce waste and carbon footprint. Urban housing demand, corporate relocation, and short-term office requirements further support growth. Operators offering modular and refurbished furniture gain market share, as environmentally responsible practices resonate with European consumers. The residential segment grows steadily due to high urban population density, while corporate rentals are strengthened by cross-border employee mobility and temporary project demands.

Asia-Pacific

APAC is the fastest-growing region (38–48%), with India, China, and Southeast Asia driving the expansion. Rapid urbanization, a large young demographic, and rising middle-class incomes fuel residential and co-living rentals. Corporate rentals are expanding in emerging economies due to temporary office projects and expatriate housing. Affordable modular solutions and refurbishment partnerships enable operators to scale efficiently in cost-sensitive markets. In addition, the proliferation of technology-enabled rental platforms enhances customer convenience and asset utilization. India and China lead residential adoption, while Singapore, Hong Kong, and Australia show high corporate rental demand due to regional business hubs.

Latin America

Latin America, including Brazil, Mexico, and Argentina, is emerging as a growing market. Economic considerations, cost-conscious consumer behavior, and limited disposable income make furniture rental an attractive option. Urbanization and the increasing need for flexible housing solutions are additional drivers. Event-driven demand and hospitality rentals contribute to growth in urban centers. Operators offering affordable, modular, and refurbished products have a competitive advantage. Brazil and Mexico are expected to capture the majority of market share, with rental furniture services gradually penetrating corporate housing and temporary project setups.

Middle East & Africa

The GCC region, led by the UAE and Saudi Arabia, alongside select urban centers in Africa, shows increasing adoption due to thriving events, exhibitions, and a transient expatriate population. Event-driven demand and temporary corporate housing requirements are primary growth drivers. High disposable income in the GCC supports premium rental services, while Africa’s emerging urban centers are gradually adopting furniture rentals for residential, corporate, and hospitality applications. Operators focusing on luxury, stylish, and short-term rental furniture, coupled with logistical efficiency, are well-positioned to capture growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Furniture Rental Service Market

- CORT

- Rent-A-Center

- Aaron’s

- AFR Furniture Rental

- Brook Furniture Rental

- Feather

- Fernish

- CasaOne

- Furlenco

- RentoMojo

- Cityfurnish

- Oliver Space

- Luxe Modern Rentals

- The Everset

- Inhabitr

Recent Developments

- In May 2025, Furlenco expanded its subscription offerings in India, introducing modular bedroom and living room packages with faster delivery timelines and integrated refurbishment services.

- In April 2025, Feather launched a B2B corporate housing platform in North America, integrating asset-light inventory and AI-driven logistics to optimize utilization and reduce delivery times.

- In February 2025, Rentomojo introduced a sustainability-focused refurbishment program in Southeast Asia, promoting circular economy practices and extending the furniture lifecycle for subscription clients.