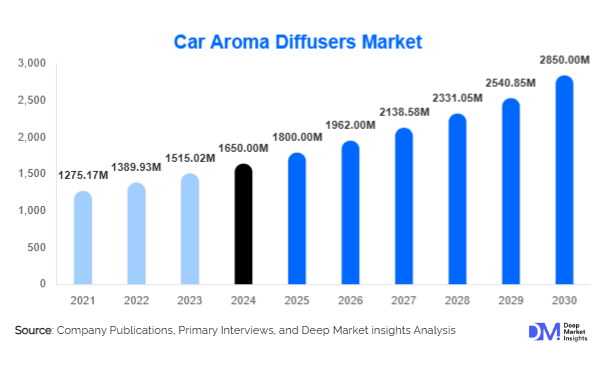

Car Aroma Diffusers Market Size

According to Deep Market Insights, the global car aroma diffusers market size was valued at USD 1,650 million in 2024 and is projected to grow from USD 1,800 million in 2025 to reach USD 2,850 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025-2030). The car aroma diffusers market growth is primarily driven by rising consumer preference for in-car personalization, wellness-oriented lifestyles, and the adoption of advanced diffuser technologies such as ultrasonic and nebulizing systems.

Key Market Insights

- Growing demand for in-car wellness products is fueling the adoption of aroma diffusers as consumers prioritize stress relief and driving comfort.

- Premium and luxury vehicles are increasingly integrating built-in aroma diffuser systems, strengthening market traction in high-income segments.

- Asia-Pacific dominates the global market, with China, Japan, and India driving mass adoption through large automotive sales volumes.

- Europe remains the fastest-growing region, supported by luxury car penetration and consumer awareness of aromatherapy benefits.

- E-commerce platforms and D2C channels are reshaping distribution, offering wide accessibility, product variety, and competitive pricing.

- Technological innovations, including smart diffusers with Bluetooth and app-based controls, are reshaping consumer expectations.

What are the latest trends in the car aroma diffusers market?

Integration with Smart Car Ecosystems

Car aroma diffusers are evolving from simple fragrance tools into smart devices that integrate with connected car ecosystems. Bluetooth-enabled diffusers now allow drivers to control scent intensity and duration through mobile apps or in-car infotainment systems. Automakers are also experimenting with built-in aroma management systems that synchronize with climate control features, enhancing the overall driving experience. This trend reflects the wider adoption of Internet of Things (IoT) technologies within the automotive sector and offers manufacturers opportunities to create premium, differentiated experiences.

Eco-Friendly and Natural Fragrance Formulations

Consumers are showing growing interest in eco-friendly, chemical-free fragrance oils. Brands are responding by launching essential-oil-based refill cartridges and biodegradable aroma pads. This aligns with the broader clean-label and sustainable product movement. Additionally, rising demand for allergen-free, non-toxic formulations is pushing innovation toward herbal, citrus, and floral blends that are both safe and long-lasting. Environmentally conscious packaging and refillable diffuser designs are becoming major differentiators in the competitive landscape.

What are the key drivers in the car aroma diffusers market?

Growing Focus on Wellness-Oriented Lifestyles

Rising global awareness around stress management and mental well-being is driving the adoption of aromatherapy-based car accessories. Consumers see in-car diffusers as a way to improve focus during commutes, reduce fatigue on long drives, and enhance overall mood. This wellness-driven demand is particularly strong in urban regions with long commuting hours, making it a critical growth driver for the market.

Rising Luxury Vehicle Sales

The premium and luxury automotive segment is increasingly integrating aroma diffusion systems as part of in-car customization. High-end brands are incorporating pre-installed diffuser systems with luxury-inspired fragrances to elevate brand experience. Rising disposable incomes, particularly in China, the Middle East, and North America, are strengthening demand for premium aroma diffusers that complement luxury driving experiences.

Expansion of E-commerce Distribution

Online retail platforms are playing a crucial role in democratizing access to car aroma diffusers. E-commerce giants and D2C brands offer affordable, mid-range, and premium diffusers with convenient subscription models for fragrance refills. Online reviews, bundled offers, and influencer-driven marketing further accelerate consumer adoption, especially among younger demographics who rely heavily on digital purchasing channels.

What are the restraints for the global market?

Price Sensitivity in Developing Markets

While adoption is rising globally, many consumers in price-sensitive markets still perceive aroma diffusers as non-essential luxury accessories. The lack of awareness regarding aromatherapy benefits and the higher cost of premium diffusers (ultrasonic and nebulizing models) limit penetration into mid- and low-income segments. Ensuring affordability without compromising quality remains a restraint for manufacturers.

Concerns Around Synthetic Fragrances

Growing consumer awareness about health risks linked to synthetic chemicals is creating hesitation toward certain diffuser products. Negative perceptions around artificial fragrances—linked to headaches or allergies—can affect adoption. Manufacturers must shift toward safer, natural alternatives and communicate product safety effectively to overcome these concerns.

What are the key opportunities in the car aroma diffusers market?

OEM Partnerships with Automakers

One of the biggest opportunities lies in partnerships between aroma diffuser manufacturers and automobile companies. Integrating pre-installed aroma systems in passenger and luxury vehicles not only enhances brand differentiation but also guarantees recurring revenues through fragrance refill sales. This trend is particularly promising in premium markets such as Europe, China, and North America, where consumers value in-car personalization.

Expansion into Emerging Markets

Rising vehicle ownership in Asia-Pacific, Latin America, and the Middle East presents an opportunity to tap into mass-market demand. Growing disposable incomes, coupled with urbanization and long commuting hours, will boost consumer adoption. Companies that can introduce affordable, durable, and refill-friendly diffusers tailored to these markets stand to capture significant growth.

Technological Innovations in Diffuser Design

Advancements such as ultrasonic atomization, waterless nebulizing diffusion, and app-controlled fragrance intensity offer manufacturers the chance to differentiate products in a crowded market. Coupled with sustainability-driven designs like refillable cartridges and solar-powered diffusers, these innovations are expected to drive long-term growth by appealing to tech-savvy and eco-conscious consumers.

Product Type Insights

Vent clip car aroma diffusers dominate the market, accounting for nearly 32% of global sales in 2024. Their affordability, ease of installation, and widespread availability through both offline and online channels make them the most popular choice worldwide. Plug-in diffusers follow closely, favored for their steady fragrance output and compatibility with USB ports in modern vehicles. Premium nebulizing diffusers, though currently a smaller share, are expanding rapidly due to rising luxury vehicle sales and increasing consumer willingness to invest in high-performance fragrance systems.

Technology Insights

Ultrasonic diffusers lead the technology segment with approximately 36% share of the market in 2024. Their popularity stems from efficient atomization, quieter operation, and compatibility with essential oil blends. Nebulizing technology, while costlier, is gaining traction in premium categories, reflecting consumer preference for stronger, natural fragrance dispersion without dilution.

Distribution Channel Insights

Online platforms dominate distribution with nearly 42% market share in 2024, driven by the convenience of product variety, subscription refill models, and competitive pricing. Offline sales through automotive accessory stores and supermarkets remain significant, particularly in emerging markets where e-commerce penetration is lower. Direct-to-consumer websites are increasingly favored by premium brands offering curated fragrance collections and loyalty programs.

End-Use Insights

Passenger cars account for over 68% of the market in 2024, making them the primary driver of demand for aroma diffusers. Within this category, SUVs represent the fastest-growing sub-segment, reflecting their popularity among families and younger buyers who prioritize comfort and personalization. Luxury vehicles are another high-growth category, as automakers integrate aroma diffusers into premium models. Commercial fleets and ride-hailing vehicles are also adopting diffusers to improve passenger experiences, creating new B2B opportunities for manufacturers.

| By Product Type | By Technology | By Fragrance Type | By Distribution Channel | By End-Use/Vehicle Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global market with a 41% share in 2024, driven by booming automotive sales in China, India, and Japan. Rising disposable incomes, urbanization, and consumer preference for comfort accessories underpin growth. China remains the largest single market, while India is the fastest-growing due to rapid motorization and increasing awareness of in-car wellness products.

Europe

Europe is the fastest-growing region with a projected CAGR of 10.2% (2025-2030). Luxury vehicle penetration, advanced consumer awareness of aromatherapy, and OEM integration into high-end cars drive adoption. Germany, the UK, and France lead demand, with premium diffuser systems gaining traction among affluent consumers.

North America

North America holds a 24% share in 2024, with strong demand from the U.S. automotive aftermarket. Consumers prioritize plug-in and portable diffusers, often purchased through online platforms. Increasing awareness of wellness-driven accessories is expected to push growth further, with opportunities in luxury car customization.

Latin America

Latin America shows steady growth potential, particularly in Brazil and Mexico. Rising vehicle sales and the popularity of affordable vent clip diffusers are the key drivers. The region is expected to see higher adoption as disposable incomes rise and e-commerce penetration deepens.

Middle East & Africa

MEA represents a smaller but growing market, supported by strong luxury car ownership in GCC countries and increasing consumer focus on premium in-car experiences. South Africa and the UAE are the leading markets, with demand concentrated in high-income urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Car Aroma Diffusers Market

- Air Spencer

- InnoGear

- Pilot Automotive

- Yankee Candle (Newell Brands)

- Godrej Aer

- Osuman

- RITUALS Cosmetics

- Febreze (Procter & Gamble)

- Grow Fragrance

- Drive Aroma

- Serene House

- Eco Breeze

- Moso Natural

- AromaTech

- BlueMagic

Recent Developments

- In June 2025, InnoGear launched a new line of smart ultrasonic car aroma diffusers featuring app-based fragrance scheduling and intensity controls.

- In April 2025, Godrej Aer expanded its product portfolio in India with eco-friendly essential oil diffuser refills, targeting urban middle-class consumers.

- In February 2025, Pilot Automotive announced partnerships with North American e-commerce giants to strengthen D2C sales channels for mid-range diffuser products.