Beauty Tools Market Summary

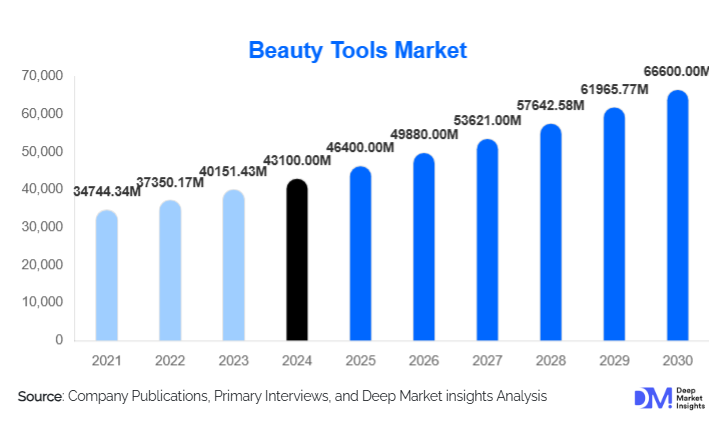

According to Deep Market Insights, the global Beauty Tools Market size was valued at USD 43,100 million in 2024 and is projected to grow to approximately USD 46,400 million in 2025, before reaching about USD 66,600 million by 2030, expanding at a CAGR of around 7.5% during the forecast period (2025–2030). The market’s growth is driven by increasing consumer demand for at-home beauty-tech appliances, the rising influence of beauty influencers and social media, and the growing adoption of sustainability and smart device integration in beauty tools.

Key Market Insights

- Hair styling & care tools dominate, accounting for roughly 30% of global market value in 2024, boosted by innovation in materials and motor/heat technologies in hair dryers, straighteners, and curling irons.

- Online retail / DTC channels continue to gain share, with 45% of spend in 2024, thanks to efficient discovery, social selling, and rising consumer comfort with purchasing devices and tools online.

- Asia-Pacific leads as the highest-value region, contributing about 33% of global spend in 2024, driven by China, South Korea, Japan, and fast growth in India and Southeast Asia.

- Skincare and beauty-tech appliances are rising fast, particularly facial cleansing tools and LED/connected devices, which are premiumizing the market and shifting spend toward higher ASP categories.

- Sustainability and clinical validation are becoming key differentiators, particularly in Europe and North America, where consumers demand materials, ethical sourcing, and regulatory safety.

- Professional-to-consumer device migration is enabling salon-grade tools to enter the home-use market, creating new growth for premium electric and smart beauty tools.

What are the latest trends in the Beauty Tools Market?

Smart & Connected Devices Taking Off

Beauty tools embedded with technology LED masks, AI skin analyzers, and app-connected facial devices, are gaining speed. Customers increasingly expect more than manual tools; they want devices that provide measurable outcomes, progress tracking, and connectivity. These devices allow brands to integrate software, subscription-based consumables or replacement parts, and digital aftercare. As these tools improve in design and safety and become better regulated, their acceptability in mature markets (the US, EU, South Korea, Japan) rises. At the same time, decreasing component costs and rising digital infrastructure in developing regions are lowering price barriers, enabling wider adoption.

Sustainability & Material Innovation

Consumers are shifting their preference toward beauty tools made from eco-friendly or sustainable materials recycled plastics, silicone, responsibly sourced natural bristles, and biodegradable packaging. Brands are introducing refillable heads, reusable pads, and take-back programs. Regulatory and consumer pressure in Europe and North America, especially among younger cohorts, is pushing sustainability claims to be verified. This trend is helping mid‐ to premium-tier brands differentiate and maintain pricing power, countering the commoditization seen in entry-level accessories.

What are the key drivers in the Beauty Tools Market?

Rising Demand for At-Home & Professional-Grade Quality

Consumers increasingly want salon-level results at home, driven by busy schedules, cost savings, and sometimes limited access to professional services. Improvements in technology better heating elements, precise motors, and safe LED systems, have made tools more effective and safer for personal use. Brands that deliver performance comparable to professional tools at accessible price points are capturing major share, especially in mature markets.

Growth of E-Commerce & Social Commerce Influence

The rise of influencers, beauty tutorials, short‐form video content, and review platforms feeds discovery and trust. Consumers often decide based on demonstration and peer feedback. Online marketplaces and brand DTC sites enable broader reach, quicker product launches, and more direct feedback loops. Shipping, return policies, and product displays (video/AR) also help reduce friction in purchase decisions for electronic and manual tools alike.

What are the restraints for the global market?

Regulatory Complexity & Safety Standards

Beauty tools that make device‐level claims (LED therapy, microcurrent, deep skin cleansing) are often subject to medical or electrical safety regulations. Different countries classify these tools differently: some treat them as cosmetics, others as medical devices. Compliance demands testing, certifications, sometimes long lead times, increasing cost, and slowing entry. Smaller brands often struggle with these barriers.

Price Pressure & Raw Material/Component Cost Volatility

In lower tiers (mass/tools/accessories), competition is intense, especially from low-cost manufacturers. When raw materials (plastic, metals, electronic components) and shipping costs rise, these margins shrink. Brands without economies of scale or strong supply chains face squeezed margins. Also, consumers in sensitive markets may resist price increases.

What are the key opportunities in the Beauty Tools Market?

Emergence of Subscription & Consumable-Linked Models

Brands that combine hardware with recurring revenue models (replacement heads, app-based upgrades, automated replenishment of disposable parts) can enhance customer loyalty and increase lifetime value. This model decreases dependence on one-time sales and helps buffer against pricing pressure in manual/accessory segments.

Expansion into Underpenetrated Markets & Local Manufacturing

Regions such as India, Southeast Asia, Latin America, and parts of Africa remain under-penetrated in the premium device categories. Local manufacturing incentives and trade-policy reforms could lower costs, improve supply chain resilience, and help brands scale locally. Localized marketing, influencer partnerships, and tailored product design (voltage, styling habits) present an opportunity.

Professional & Clinical Validation as Differentiator

Tools that undergo clinical testing or meet higher safety/medical standards gain consumer trustespecially for skincare devices and beauty-tech appliances. Partnering with dermatologists, obtaining certifications, or publishing study results can allow brands to charge premiums and access professional / clinic channels. This is especially relevant in developed markets with stricter regulations.

Product Type Insights

The leading product type is hair styling & care tools, dominating around 30% of global value in 2024. Growth in this segment is primarily driven by technological innovations such as heat-protective devices, faster-drying hair appliances, and multifunctional tools, which save time and reduce hair damage. Celebrity endorsements and influencer marketing have further boosted adoption, making hair tools a high-demand category. Makeup brushes and sponges follow with approximately 20% of market share, supported by frequent replacement cycles and growing interest in personal grooming and cosmetic application precision. Skincare devices such as cleansing brushes and LED masks account for 18% of market value, with growth propelled by increasing consumer awareness of skin health, anti-aging concerns, and the desire for professional-quality results at home. Smart home beauty and connected devices represent 10% of the market, with the fastest growth and margin expansion, driven by app connectivity, personalized skincare routines, and integration with wellness-focused technologies.

Distribution Channel Insights

Online and direct-to-consumer (DTC) channels captured approximately 45% of total market spend in 2024, a figure that continues to rise with social commerce, influencer marketing, and immersive product demonstrations. E-commerce platforms, brand stores, and marketplaces provide ease of discovery, transparent pricing, and convenient delivery, fueling growth especially in emerging markets. Offline channels remain relevant for high-touch experiences: specialty beauty stores, salons, and professional supply stores cater to premium users who prefer hands-on evaluation. Mass retail and supermarkets dominate the entry-level segment. High-ticket beauty appliances increasingly leverage a hybrid strategy—online discovery combined with offline demonstrations—to improve consumer confidence and conversion.

End-Use Insights

The largest end-use segment is personal / at-home consumer usage, accounting for 70% of the market in 2024 and experiencing the fastest growth due to rising consumer interest in at-home professional-quality beauty solutions. Professional / salon users represent roughly 25% of demand, particularly in hair care and professional-grade styling tools, ensuring recurring purchases and influencing consumer trends. Clinical and dermatology use constitutes 5% of the market share, with growth fueled by premium skincare devices and rising adoption of tele-dermatology solutions. Emerging applications in wellness integration, personalized skincare analytics, and digital beauty consultations are opening new revenue streams and extending usage beyond conventional personal and professional segments.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, contributing approximately 33% of global spend in 2024. Key markets include China, South Korea, Japan, and rapidly growing secondary markets such as India, Thailand, and Indonesia. Growth is supported by a cultural emphasis on beauty and grooming, particularly skincare routines in East Asia, combined with rapid urbanization that increases disposable income and access to premium beauty products. Influencer culture, strong e-commerce penetration, and rising awareness of personal care technologies further propel adoption. Hair appliances dominate South Asia, while premium skincare devices and connected beauty tools are highly sought after in East Asia.

North America

North America accounts for roughly 28% of the global market in 2024, led by the U.S. with high per-capita expenditure and strong adoption of smart and AI-enabled beauty devices. Canada shows similar adoption trends on a smaller scale. Growth drivers include the influence of social media platforms like Instagram and TikTok, which shape beauty trends and drive consumer interest in innovative tools. Mature consumers prioritize safety, performance, and brand reputation, supporting sustained demand for technologically advanced devices and professional-grade at-home solutions.

Europe

Europe contributes about 22% of global spend, with key markets including the U.K., Germany, France, Italy, and Spain. The region’s growth is fueled by sustainability trends, where consumers increasingly prefer eco-friendly and responsibly sourced beauty tools. Regulatory support and initiatives promoting wellness, personal care, and standardized safety measures further encourage adoption. While premium devices see slower uptake in some countries without clinical validation, growing interest in green and certified products is driving mid- to high-end segment expansion.

Latin America

Latin America holds around 8% of the global market, with Brazil and Mexico being the dominant contributors. Growth is driven by rising disposable income, improving retail and e-commerce infrastructure, and a cultural shift toward personal grooming. Price sensitivity remains a key consideration, leading to strong competition among both domestic and international brands. Social media and influencer marketing are increasingly shaping consumer preferences.

Middle East & Africa

MEA represents approximately 9% of the global market. The GCC countries, including the UAE and Saudi Arabia, demonstrate strong demand for premium and luxury beauty tools due to affluence and an emphasis on personal appearance in social contexts. Africa’s secondary markets, such as South Africa and Nigeria, are experiencing faster growth driven by urbanization, rising middle-class disposable income, and expanding online access. Cultural significance of grooming and increased awareness of modern beauty tools are key factors driving regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Beauty Tools Market

- L’Oréal Group

- Procter & Gamble

- Unilever

- Estée Lauder Companies

- Shiseido Company

- Dyson

- Philips

- Panasonic

- Conair Corporation

- Wahl Clipper Corporation

- Kao Corporation

- Amorepacific Corporation

- Coty Inc.

- Revlon, Inc.

- T3 Micro

Recent Developments

- In June 2025, a major appliance maker expanded its premium hair dryer line with embedded temperature sensors and AI-controlled heat styling to reduce hair damage, targeting the U.S. and EU markets.

- In April 2025, a beauty-tech startup in South Korea launched an app-connected LED mask with replaceable LED panels and subscription features for skin diagnostics.

- In March 2025, India’s local beauty tools manufacturers received government incentives under “Make in India”-style programs to set up domestic production of electric beauty appliances, reducing import dependence and cutting costs.