Bamboo Disposable Nappies Market Size

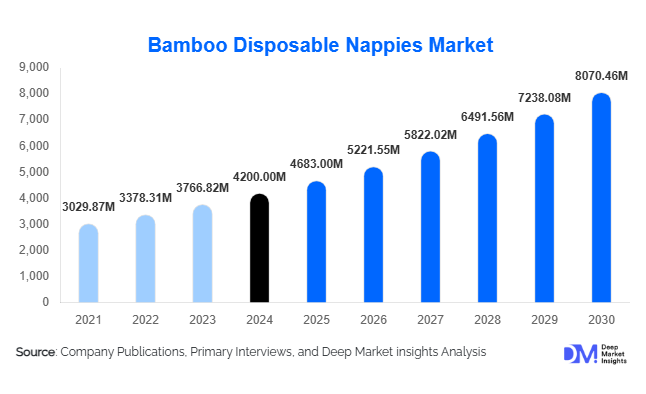

According to Deep Market Insights, the global bamboo disposable nappies market size was valued at USD 4,200 million in 2024 and is projected to grow from USD 4,683 million in 2025 to reach USD 8070.46 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of eco-friendly baby care products, rising demand for hypoallergenic and biodegradable nappies, and expanding e-commerce channels enabling wider product accessibility across global regions.

Key Market Insights

- Eco-conscious parenting is driving demand for bamboo-based nappies, as bamboo offers natural softness, antibacterial properties, and a lower environmental footprint than conventional synthetic nappies.

- Premium and organic segments are growing rapidly, especially in developed markets like North America and Europe, where consumers are willing to pay a price premium for sustainable and certified products.

- Asia-Pacific dominates the market, with China, India, and Southeast Asia contributing the largest shares due to rising disposable income and increasing birth rates.

- Online retail and subscription models are reshaping distribution, allowing direct-to-consumer sales and stronger consumer engagement for eco-friendly and premium products.

- Product innovations, including high-absorbency overnight nappies, wetness indicators, and compostable packaging, are boosting consumer adoption and brand differentiation globally.

- Government regulations and environmental initiatives, such as restrictions on single-use plastics and promotion of biodegradable products, are creating favorable market conditions for bamboo nappies.

What are the latest trends in the bamboo disposable nappies market?

Eco-Friendly and Biodegradable Products Leading Adoption

Manufacturers are increasingly producing nappies with biodegradable cores, bamboo liners, and minimal plastic packaging. Eco-certifications, including OEKO-TEX, FSC, and organic labels, are becoming standard to validate environmental claims. Rising awareness among parents about chemical exposure and skin sensitivity has led to higher adoption of bamboo nappies in both developed and emerging markets. Compostable and zero-waste packaging solutions are also gaining traction, particularly in regions with supportive infrastructure and recycling policies.

Digital and Subscription-Based Sales Growing Rapidly

Direct-to-consumer online channels and subscription models are transforming how bamboo nappies are purchased. Brands are leveraging e-commerce, social media, and influencer marketing to target eco-conscious parents. Subscription services provide convenience for regular delivery, often bundled with value-added offers like discounts, trials, and loyalty rewards. Online platforms also facilitate education about sustainability benefits, creating brand trust and stronger customer retention. These channels are particularly strong in North America, Europe, and the urban areas of the Asia-Pacific.

What are the key drivers in the bamboo disposable nappies market?

Rising Eco-Conscious Parenting

Parents are increasingly choosing sustainable and non-toxic products for their infants. Bamboo nappies, with natural antimicrobial properties and reduced plastic usage, address environmental concerns and baby skin safety. The trend is particularly strong in urbanized and high-income regions, driving demand for premium and organic options. Awareness campaigns, social media influence, and parenting forums further amplify this trend.

Premiumization and Willingness to Pay

Consumers are showing a willingness to pay a premium for eco-friendly, certified, and high-performance nappies. Premium bamboo nappies provide better absorbency, comfort, and skin protection, justifying higher prices. Developed markets in North America and Europe lead this trend, while emerging markets in APAC are gradually adopting premium products as disposable incomes rise. This premiumization supports profitability for established players.

Innovation in Product Design and Features

Recent innovations include overnight absorbency, wetness indicators, hypoallergenic liners, and fully biodegradable packaging. These features improve user experience, reduce diaper rash, and address environmental concerns, helping brands differentiate themselves. Continuous R&D in bamboo fiber processing, compostable materials, and sustainable adhesives is driving product performance, fueling market expansion.

What are the restraints for the global market?

High Production Cost and Price Sensitivity

Bamboo nappies are more expensive than conventional disposable nappies due to raw material costs, manufacturing complexity, and certifications. Price-sensitive consumers in emerging economies may continue to prefer cheaper synthetic alternatives, limiting adoption. Brands must balance premium positioning with affordability to maintain market penetration.

Limited Composting and Biodegradability Infrastructure

Even when products are biodegradable, inadequate industrial composting facilities in many regions restrict the environmental benefits. Regulatory discrepancies in what qualifies as biodegradable or compostable may cause consumer confusion, impacting purchase decisions. Infrastructure development is crucial to maximizing sustainability claims and enhancing market acceptance.

What are the key opportunities in the bamboo disposable nappies industry?

Expansion in Emerging Markets

Regions such as India, Southeast Asia, and Latin America present vast growth potential due to rising middle-class populations, increasing birth rates, and higher awareness of eco-friendly products. Localized manufacturing and affordable premium offerings can capture untapped demand in these regions.

Technological and Product Innovations

Brands can differentiate through enhanced absorbency, overnight performance, wetness indicators, and fully compostable packaging. Adoption of smart features and circular economy initiatives, such as take-back or recycling schemes, can increase brand loyalty and drive sales.

Government Initiatives and Regulatory Support

Policies promoting biodegradable products, restricting single-use plastics, and encouraging sustainable manufacturing create opportunities for market expansion. Aligning with environmental regulations enhances credibility and access to institutional buyers like hospitals and nurseries.

Product Type Insights

Premium and organic bamboo nappies dominate the market, offering superior comfort, hypoallergenic properties, and biodegradable features. Mid-range options appeal to cost-conscious consumers seeking a balance of eco-friendliness and affordability. Budget bamboo nappies, though smaller in market share, are gradually gaining traction in emerging economies through cost-effective production and online retail. Pant-style nappies are leading globally due to ease of use for older infants and toddlers, representing nearly 40–45% of the 2024 market.

Application Insights

Home use remains the largest application segment, accounting for 70–80% of demand. Daycare centers, nurseries, and hospitals are also significant end-users, particularly for newborn and hypoallergenic products. Travel and overnight use are growing niche applications, where high absorbency and convenience drive preference for bamboo nappies. Export-driven demand from Asia-Pacific to Europe and North America further supports these application segments.

Distribution Channel Insights

Online retail channels, including e-commerce platforms and direct-to-consumer subscription models, dominate due to convenience, targeted marketing, and the ability to showcase eco-credentials. Supermarkets, hypermarkets, specialist baby stores, and pharmacies continue to hold substantial market share, particularly in regions with mature retail infrastructure. Emerging channels include boutique eco-stores and subscription services in developing markets.

End-Use Segment Insights

Household consumption is the primary driver of bamboo disposable nappy demand. Fastest-growing end-use segments include overnight use at home, nurseries/daycare, and hospitals for newborn care. Emerging applications include travel packs and eco-friendly institutional procurement. Export-driven growth from manufacturers in Asia to developed markets in Europe and North America further fuels demand.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 15–20% of the global market, with strong demand from the U.S. and Canada for premium and organic bamboo nappies. High disposable income, environmental awareness, and established e-commerce channels are key growth drivers.

Europe

Europe represents 20–25% of the global market, led by Germany, the U.K., France, and the Nordics. Consumers favor eco-certified, hypoallergenic products. Rapid adoption of sustainable packaging and premium segments makes Europe a high-value market.

Asia-Pacific

Asia-Pacific dominates with 35–40% market share. China, India, and Southeast Asia are witnessing the fastest growth (CAGR 13–15%) due to rising disposable incomes, growing birth rates, and increased awareness of sustainable baby care products. E-commerce penetration and local manufacturing enhance accessibility.

Latin America

Latin America contributes 5–7% of the market, with Brazil and Mexico leading demand. Growth is driven by increasing awareness and rising middle-class incomes, though price sensitivity remains a challenge.

Middle East & Africa

Accounting for 3–5% of the global market, demand is growing in the UAE, Saudi Arabia, and South Africa due to higher per capita income and interest in premium eco-products. However, limited infrastructure and price constraints are restraining broader adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bamboo Disposable Nappies Market

- Mama Bamboo

- Bambo Nature

- Andy Pandy

- Eco by Naty

- Bambiboo

- LittleLamb

- Tooshies

- Earth + Eden

- Honest Company

- Seventh Generation

- Pampers Pure (premium bamboo range)

- Huggies Special Edition Bamboo

- Nature Babycare

- Babyganics

- Earth’s Best

Recent Developments

- In March 2025, Bambo Nature expanded its production line in Denmark to include fully compostable bamboo nappies for European markets.

- In April 2025, Mama Bamboo launched a subscription model in India and Southeast Asia to cater to eco-conscious parents with regular delivery services.

- In May 2025, Eco by Naty introduced a high-absorbency overnight bamboo nappy with improved wetness indicators, targeting the North American and European premium segments.